The Multiplier Effect, MPC and MPS

Let’s say I give you $1,000. This is 100%. Out of this $1,000 you save 20% and use the remaining to buy stuff. This means that the Marginal Propensity to Save is 20%, or $200, and the Marginal Propensity to Consume is 80% or $800.

So in this case: 20%*MPS+80%*MPC = 1 or in a more general form: MPS + MPC = 1

Now that we have this out of the way, let’s introduce a concept called the Spending Multiplier. When someone has more disposable income, they can either spend it or save and this has a non-linear relationship with the amount of money that circulates in the Economy.

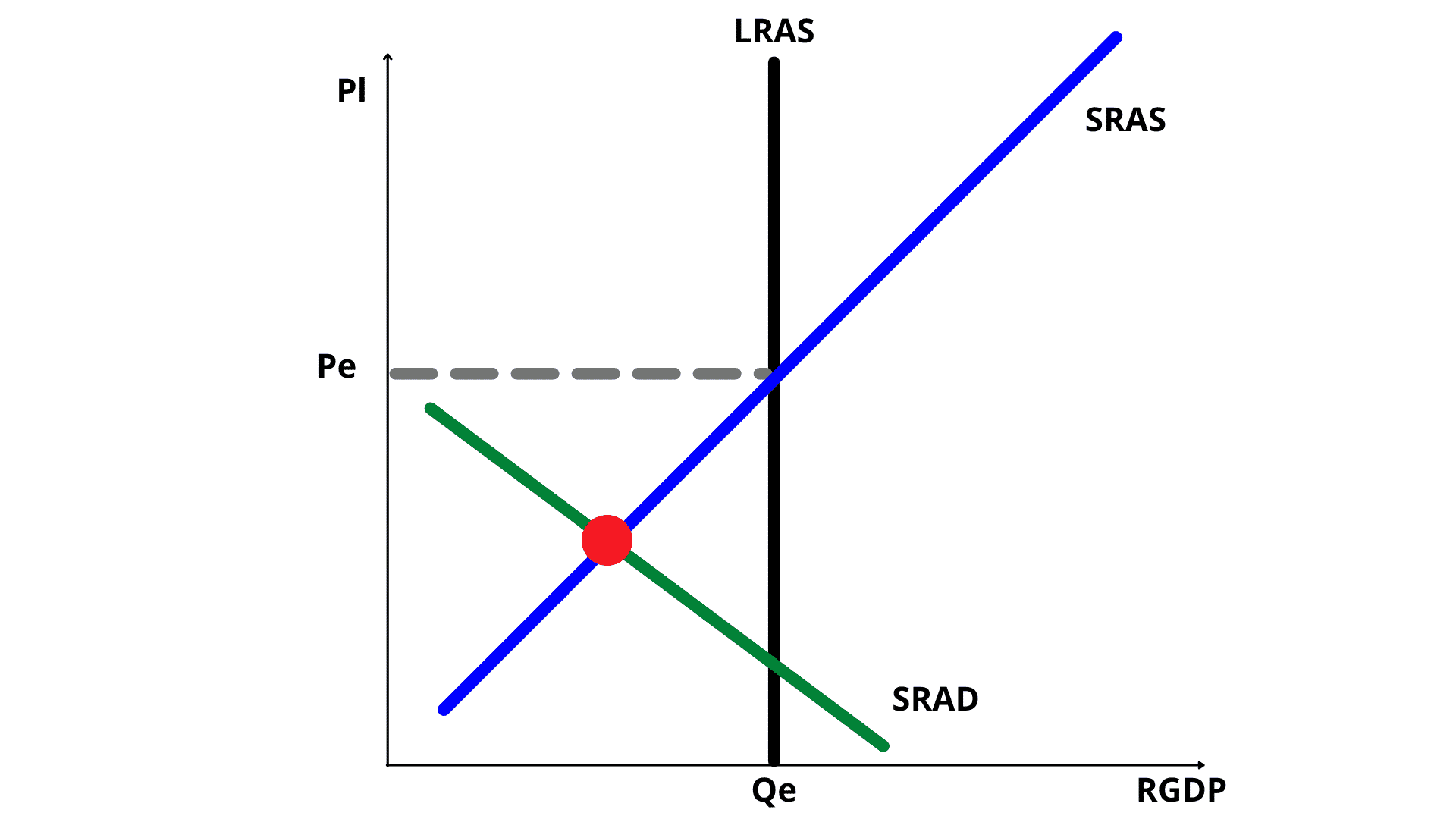

So, let’s say the Economy is in a recession, and Congress decides to increase Government Spending in order to stimulate growth. By looking at the first graph it seems that to close the gap, the amount of money necessary as Government spending would be the quantity from the red dot to the point it intersects the LRAS.

Strangely enough, that is not what happens.When people get money, they spend a part of it and save another part of it.

And someone’s spending is another person’s income. So let’s say the Government decides to spend on Tech Hubs – VC’s are there, experienced entrepreneurs help your startups. Out of these, some take-off, consumption of this newly created product or service increases, jobs are created to keep the company working, so $1 multiplied itself many fold.

If the Goverment fails to take in consideration the multiplier effect, by just spending the amount to take the Real GDP from point A to Equilibrium, they will take the Economy from a Recessionary Gap directly to an Inflationary gap as this is not a linear relationship.

How can the Government do this?

The solution is to understand more about consumer propensities either to save or consume.

Starting with our first equation where MPC + MPS = 1, the mutiplier is an inverse relationship: 1/MPS.

Notice how in the denominator, the terms and relationship is the same. The MPS is the change in savings divided by the change in income. The latter can be found by either using the direct MPs or its relationship 1-MPC.