In this article I will guide you through each step towards getting your golden visa. No fluff, straight to the point information. I’m a practical guy, I like practical people, so let’s go.

Table of Contents

1. What is the Golden Visa?

2. Which countries offer the Golden Visa?

3. Why does Portugal offers the most popular Golden Visa Program?

4. What are the benefits of the Golden Visa?

5. What are the steps to obtain the Golden Visa?

1. What is the Golden Visa?

The Golden Visa is an investment scheme created by a couple of countries traced back to the eighties, to encourage non-country residents to invest in the country of choice. It was known as a cash-for-passport program.

Today, the basic ideia is the same. Countries that offer the Golden Visa are looking for outside capital to stimulate the Economy.

In return, the foreign investor gets tax-sheltering benefits and be part of a special Residence Permit Program extended to his family.

2. Which Countries offer the Golden Visa?

These are the countries that offer the Golden Visa. Some call it a different name, but the general concept is the same.

Portugal

Malta

Cyprus

Austria

United Kingdom

United States

Canada

Antigua and Barbuda

Saint Kitts and Nevis

Spain

Latvia

Monaco

Bulgaria

Ukraine

Grenada

Abkhazia

Saint Lucia

Australia

Hong Kong

Singapore

UAE

Dominica

3. Why does Portugal offer the most popular Golden Visa Program?

Portugal has become the most popular country to offer the Golden Visa Program, for two reasons:

1. It has one of the best Cost-Benefit relationship

From the benefit side, Portugal has a nice and sunny weather, low-cost of living, it’s a safe country to raise a family, the tech scene is booming, and there are several real estate opportunities here. From the cost side, comparing to other countries that offer the same program, the minimum cost requirements for Portugal are a lower ticket price than the rest.

Now, just one head’s up: I am not saying Portugal is perfect, far from it, remember that I was born here… but as a second residence of choice, I can see why people do it. I would do it for the same reasons.

2. It’s a Tax-Haven for investors

The main one is the 0% inheritance tax in Portugal, as long as the assets are passed on to immediate relatives (wife/husband, kids). Done right, you can benefit from other tax benefits by establishing yourself in Portugal. Besides this one, there are other tax-benefits that we will cover in a bit.

4. What are the benefits of the Golden Visa?

There are several benefits of the Golden Visa Program if you are thinking about this. The main one is related to tax.

1. Flat-Rate of 20% for high value-added activities

Special tax regime for Non Habitual Residents (NHR), who transfer their tax residency to Portugal and have not been considered as tax resident in the past five years. Under the NHR, income derived from “high value-added activities” is taxed at a 20% rate.

You can check the skewed and highly questionable list of “high value-added activities” here. If they don’t list yours, just choose a “grey-area” one.

2. Foreign Pension Income is exempted from taxation in Portugal

Under the NHR Regime, foreign pension income should be exempted from taxation in Portugal.

3. Foreign Interest and Dividends are exempted from taxation in Portugal

Under the NHR, foreign interest and dividends may be exempted from taxation in Portugal.

Tax Authorities issue tax resident certificates for NHR taxpayers.

4. Capital Gains are taxed at a flat rate of 28%

Capital Gains arising from the sale of shares are, in general, taxed at a flat rate of 28%.

5. There is no inheritance/gift nor wealth tax.

Contrary to a great deal of countries like the USA, UK or Japan that charge an inheritance tax from 40% to 55%, Portugal has a 0% inheritance tax, which makes this a compelling case.

If you are from one of these countries, here’s how much they charge:

Japan 55%

South Korea 50%

France 45%

United Kingdom 40%

United States 40%

Spain 34%

Ireland 33%

Belgium 30%

Germany 30%

Chile 25%

Greece 20%

Netherlands 20%

Finland 19%

Denmark 15%

Iceland 10%

Turkey10%

Poland 7%

Switzerland 7%

Italy 4%

6. Special tax regime for Non Habitual Resident (NHR)

When transfering tax residency to Portugal, and if you have not been considered as a tax resident for the past five years, you’ll benefit from all the mentioned advantages.

Other benefits include:

7. Visa Exemption

By having a Golden Visa or by being registered as a Non-Habitual Resident, you will have Visa exemption to freely enter Portugal and travel in the Schengen area.

The Shengen Area is composed by 26 Countries. Here’s the list:

Austria

Belgium

Czech Republic

Denmark

Estonia

Finland

France

Germany

Greece

Hungary

Iceland

Italy

Latvia

Liechtenstein

Lithuania

Luxembourg

Malta

Netherlands

Norway

Poland

Portugal

Slovakia

Slovenia

Spain

Sweden

Switzerland

Stay, Live and work in Portugal.

You can stay, live and work in Portugal as long as the you follow the following conditions:

– stay a minimum of seven days during the first year

– stay at least fourteen days in the following subsequent years.

Family Reunification

Your visa will allow you to bring your parents, spouse and children under or over eighteen that are studying and financially dependent on you as the applicant.

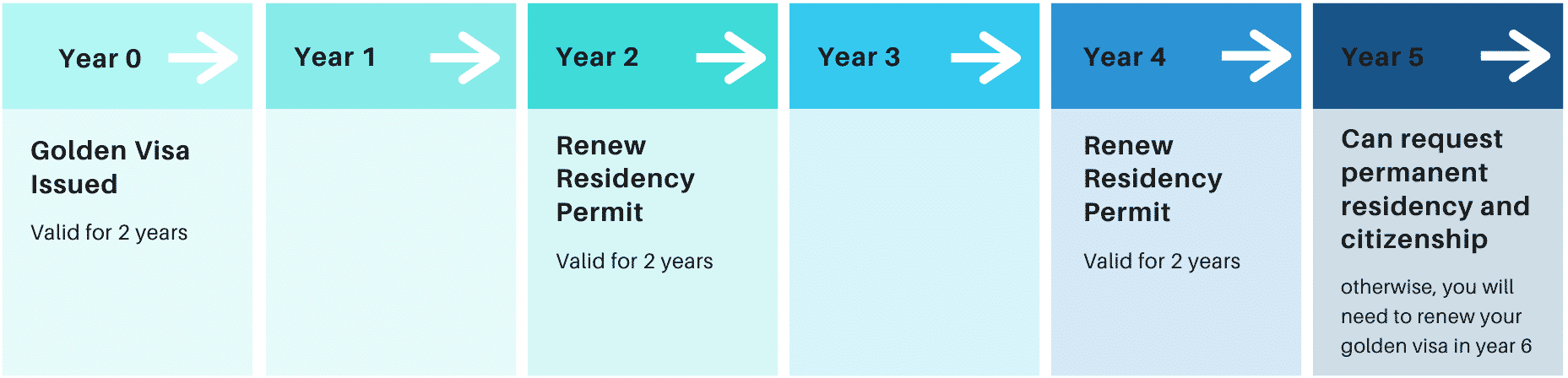

Permanent Residence

After five years, you can apply for a permanent residency.

Citizenship

After six years of living in Portugal, you can apply for a citizenship.

5. How to obtain the Golden Visa?

To obtain the Golden Visa for Portugal, there are five main steps to follow:

1. Choosing your legal representative

There are steps you can take to complete the operation from outside Portugal, but there are other steps you will need help within the country. To do this properly, do your due diligence and choose someone within the country that can help you get this done.

Usual fees that I have come accross range from €500 to €5.000. The first being a price-taker, the latter clearly overcharging. Remember that these are their fees, all other incurred expenses are on you.

Nonetheless, it is a good idea to hire a legal representative or a boutique firm that has all the required people, so you can save your time from this process.

The three main documents required from you at this stage to provide are:

a) Providing your Passport

b) Providing Proof of Residency (your actual one outside Portugal)

c) Provide Power of Attorney to your legal representative

2. Your representative will ask for the new Portuguese Fiscal Number to be sent to his office in Portugal

After choosing your representative, the main correspondence will be sent there. The first step is to ask for the NIF(Portuguese Fiscal Number) to be sent there.

3. After obtaining your fiscal number with a proof of address in Portugal(usually the one from your legal representative, you can now open the company)

Opening your company can be done 100% online here https://eportugal.gov.pt/inicio/espaco-empresa

After completing the incorporation, all the legal documentation will be accessible online as well.

The main two codes you will get at this step are:

1. Código da Certidão Permanente (Permanente Certificate Code)

2. Código RCBE (RCBE Code)

5. Open a bank account

After opening your company, you can open a bank account here. The banks will ask for:

1. Personal id card/passport

2. Proof of residency – legal office here from your representative will do.

3. Código da Certidão Permanente + Código RCBE

With these documents, they will run a check on the paperwork and if everything is validates, they will tell you when you can drop by to sign some stuff. From this documentation, you will obtain your online user and password for your homebanking. Remember to ask for a signed and stamped document from them saying you deposited the company’s initial equity capital.

4. Do the investment

To obtain the Golden Visa for Portugal, you have to make an investment in one of these three possible routes:

1. Real Estate

Option 1 – The acquisition of real estate with a value equal or greater than €500.000 as equity. Note that it can be a combination of acquisitions, it doesn’t need to be one asset only.

Option 2 – The acquisition of real estate with its original development dating back more than thirty years or if it is located within urban areas for the purpose of renovating, for a total value equal to or above €350.000.

This type of investment may be made by more than one individual, or as shareholder of a single member limited company.

2. Capital Transfer

Option 1 – A capital transfer to Portugal of at least €1.000.000. It can be an investment in shares of a company;

Option 2 – A capital transfer equal or greater than €350.000,with the purpose of investing in R&D activities by public or private scientific institutions, integrated within the national scientific and technological system;

Option 3 – A capital transfer equal or greater than €250.000, to support artistic production, recovery or maintenance of national cultural heritage, through certain legally defined institutions;

Option 4 – A capital transfer equal or greater than €350.000 as shares of investment funds. These can be SPV’s and VC Funds that have investments in Portuguese companies. The maturity of these investments is usually five years.

3. Job Creation

Option 1 – Creation of at least 10 new jobs;

Option 2 – A capital transfer equal or greater than €350.000 as shareholder’s equity in a Portuguese incorporated company with its main office in Portugal. This has to be combined with the creation of five permanent working jobs, or for the reinforcement of the share capital of an existing Portuguese company. The investment must hold for a minimum period of three years.

Note: If the investment is carried out in low density Portuguese areas, it can be reduced by 20%.

3. What is the Portugal Golden Visa’s processing time?

Golden Visa’s Changes Timelime

Before December 31st 2021

1 – Onboarding

2 – Bank account & NIF

3 – Make the investment

4 – Online application

From January 1st 2022

5 – Pre-approval

6 – Biometrics visit

7 – Golden Visa issuance

Golden Visa Portugal required document list:

1. Portugal Golden Visa application form

2. Copy of a valid passport and travel documents

3. Deed or contract of the purchased property or signed promissory contract with proof of the deposit payment

4. Declaration from your bank in Portugal confirming the transfer of funds

5. Proof of Health Insurance in Portugal (only required if the investor resides in Portugal)

6. Certified copy of the criminal certificate or a Police clearance letter from your country of origin

7. completed form authorizing SEF to get an extract of your Portuguese criminal records

8. Declaration from you confirming compliance with the investment requirements

D9. ocuments showing a good standing with the Portuguese Tax and Customs Authority and Social Security system. These can be issued 45 days prior to your online application

9. A receipt showing that you already paid the application processing fee

Note that the certificates of criminal records or police clearance letters must have been issued no more than 90 days before submitting your application. For all other certificates, it is 180 days.

Legalizing Portugal Golden Visa documents

Portugal Golden Visa documents and the Portugal Golden Visa application form must be legalized and translated into Portuguese by a certified translator.

Documents can be legalized either by the Portuguese Consulate or by the Apostille of The Hague Convention.

Translating Portugal Golden Visa documents

Original documents must be accompanied by a certified translation in Portuguese, which may be done in one of three ways:

– By a translator who is accredited by the Portuguese Consulate

– By anyone, if the translation is certified by a Portuguese lawyer

– By the issuing country’s Consulate in Portugal

Portugal Golden Visa language test

If you want to get a Portuguese citizenship after your five-year investment is up, then you must take the Portuguese language test for citizenship. This test, called The CIPLE, checks to see if you have a basic understanding of the Portuguese language.

Portugal Golden Visa cost

These are the Portugal Golden Visa’s costs:

Initial Application Fees: €6,000.

For a single applicant. If applicant has dependents younger than 18 years-old, they can be included free of charge.

For dependents 18 years-old and older there is a €500 fee per person.

Renewal Legal Fees

For a single applicant = €1,000.

For a single applicant. If applicant has dependents younger than 18 years-old, they can be included free of charge.

For dependents 18 years-old and older there is a €500 fee per person.

*Note that Fees are subject to change, depending on given updated from the Portuguese government on the Golden Visa Program.

Hi Friend!

I'm Diogo, a specialized life insurance broker. I like to help people to have clearer information about the services they purchase.

I created this website to help you better understand why you should have life insurance.

Share this post on social media

RECENT POSTS

datas obrigações pessoas colectivas

faz download aqui das datas de todas as obrigações de empresas colectivas com finanças e segurança social. Adiciona ao teu google calendar

Como usar um seguro de vida para financiar stock-options

Neste artigo vamos ver como usar um seguro de vida para financiar stock-options.