The acquisition process goes through 3 main steps:

-

A thorough study of the financials of the companies we are interested in.

-

The analysts filter the best ones.

-

The group further studies the company and assesses its valuation.

The valuation process goes through several metrics and items: sales, EBITDA margins, debt levels, and a series of qualitative and quantitative processes to arrive at an intrinsic value of what we think the business is worth.

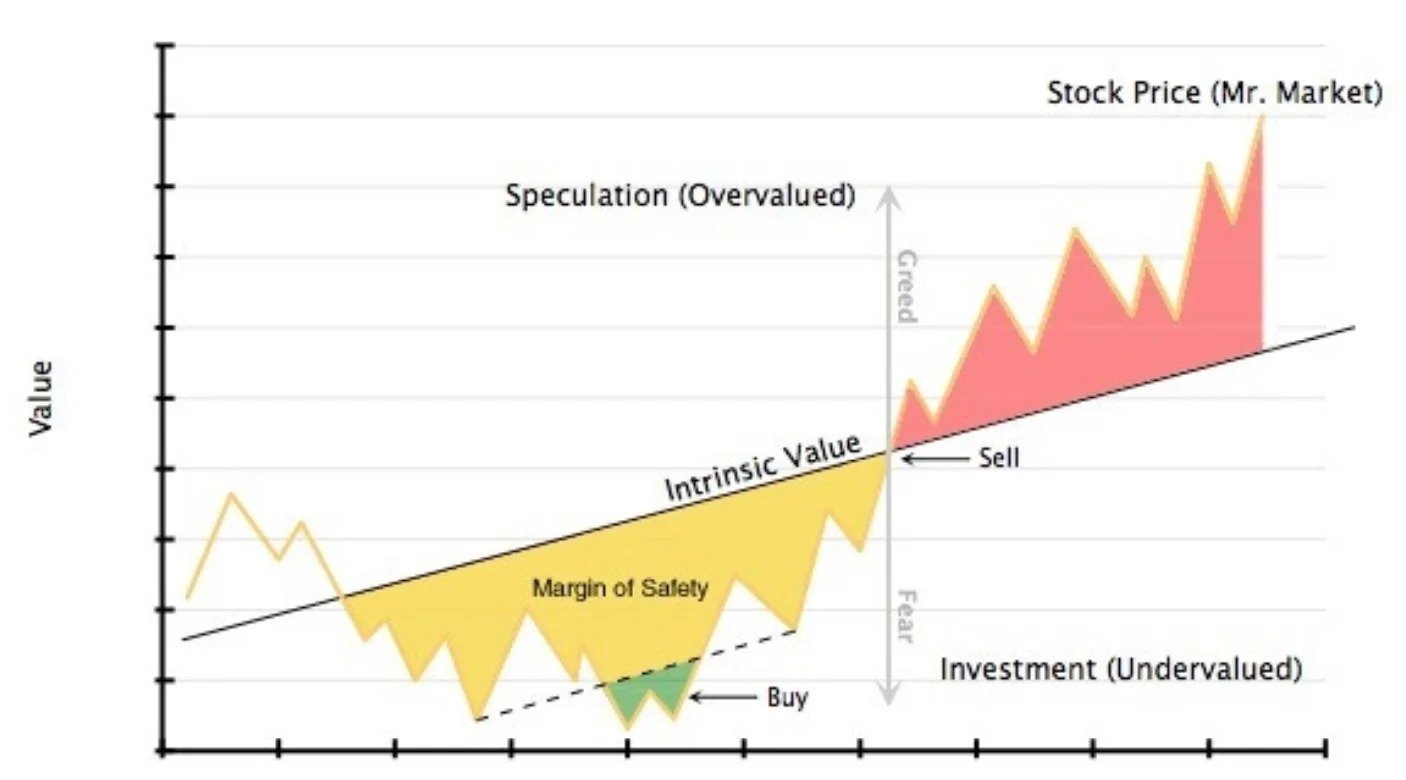

The acquisition proposed price will always be below the intrinsic value, with a certain margin of safety of what we can propose as an acquisition.

We look for shareholder’s equity amount twice as much as the total liabilities, proof of the growth of earnings of at least 15% for the last 5 years, among several other aspects.

We use scores like Beneish-M that uses an 8-factor valuation to see if the company is manipulating the results:

-

DSRI – Days’ sales in receivable index

-

GMI – Gross margin index

-

AQI – Asset quality index

-

SGI – Sales growth index

-

DEPI – Depreciation index

-

SGAI – Sales and general and administrative expenses index

-

LVGI – Leverage index

-

TATA – Total accruals to total assets

We use the Piotrosky Score, which arrives at a number between 0-9 to conclude the company’s financial strength in terms of profits, leverage, liquidity, operational efficiency, and several other metrics.

As an example, we will show you how to evaluate Walmart

In valuation, you always start with the assets and look to the earnings power and see if it is protected by the assets. Only then do you look to pay something for growth, protected by a significant margin of safety of what you think the company is worth?

You basically ask yourself:

“Is this company will still be here? Can we get a 15% conservative growth

from this company? Is there room to keep growing?”

Remember that growth is only valuable if the investment in growth earns more than the cost of capital. Put it another way, if you have interest payments on the raised capital to start and operate the business, and this cost is higher than the growth of the business, that is a horrible investment. So, you must always have a lower cost of capital than the growth of the earnings of the company.

“Is there a competitive advantage? Barriers to entry like scale or a monopoly, customer protection, a patent, technology? Or is it something that any fool can start today?”

A business by definition must be something much better than what exists presently because the ones already operating are usually pretty good at what they do. So it must be something better:

Not necessarily something new, but something that solves a problem better.

Coming back to our EPV model, the valuation idea is: “how much would you pay for the replica of Walmart today, and still get the same results? “Out of this question, we will get a price/share that is either higher, same, or lower than the current market price.

Only then you can make an assessment regarding the investment in that company, meaning you could create this company from scratch and have the same results as they are presently having.

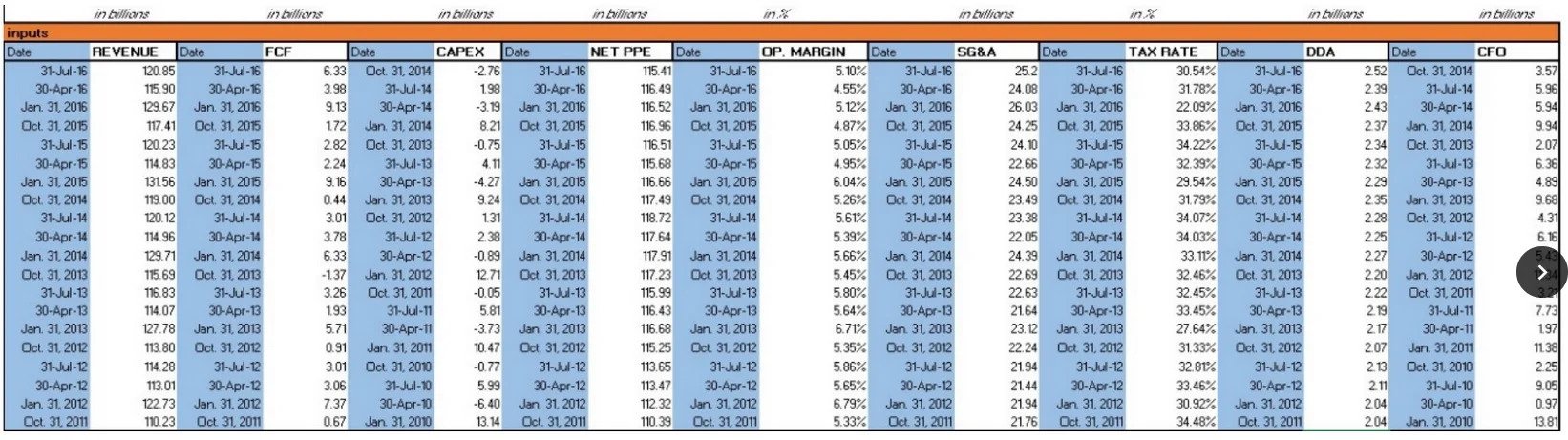

For the first step, you will need to create an excel section with the inputs, as shown below:

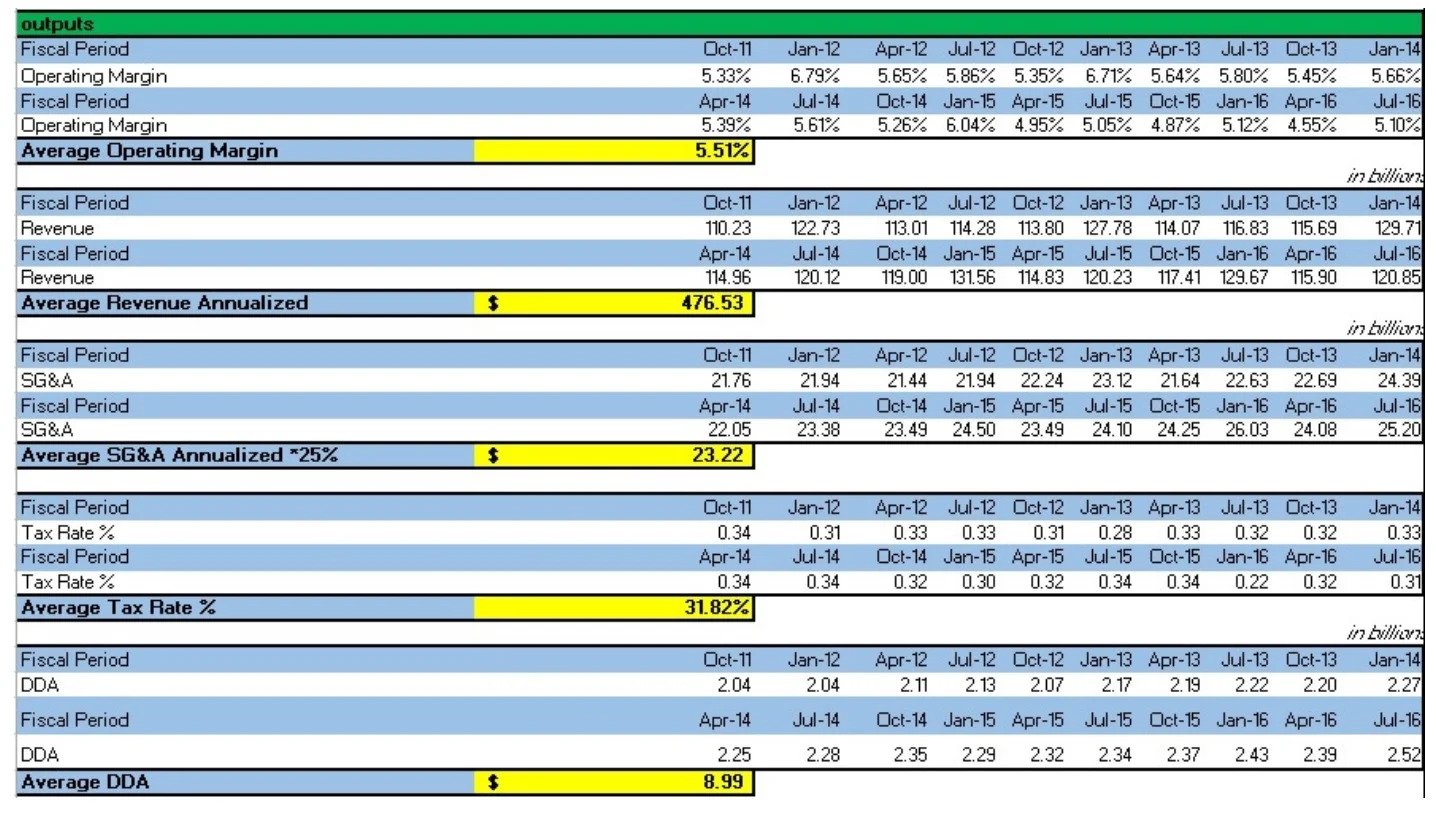

For the second step, you will need to create the input section, as shown below:

For the third step, you must consider that:

Excess Depreciation = Average Tax Rate x Average DDA

Normalized EBIT = Average Profit Margin + Average Revenue Annualized + Average SG&A Annualized x 25%

After-Tax Normalized EBIT = Normalized EBIT x (1 – Av. Tax Rate)

Normalized Earnings = Excess Depreciation + After Tax Normalized EBIT

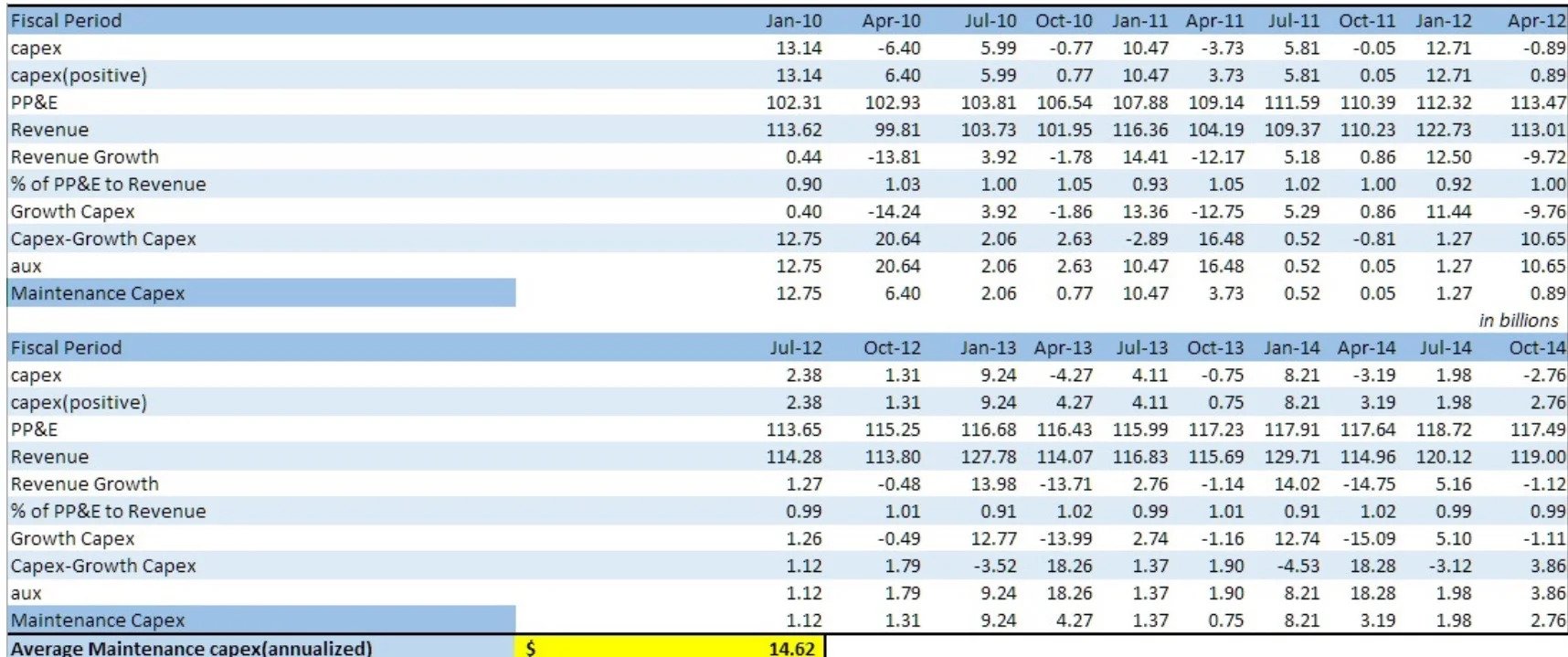

The next step is to calculate the Average Maintenance CAPEX (Capital Expenditures, meaning what the company needs to reinvest every year in the business to keep it working at the present stage). See the table below:

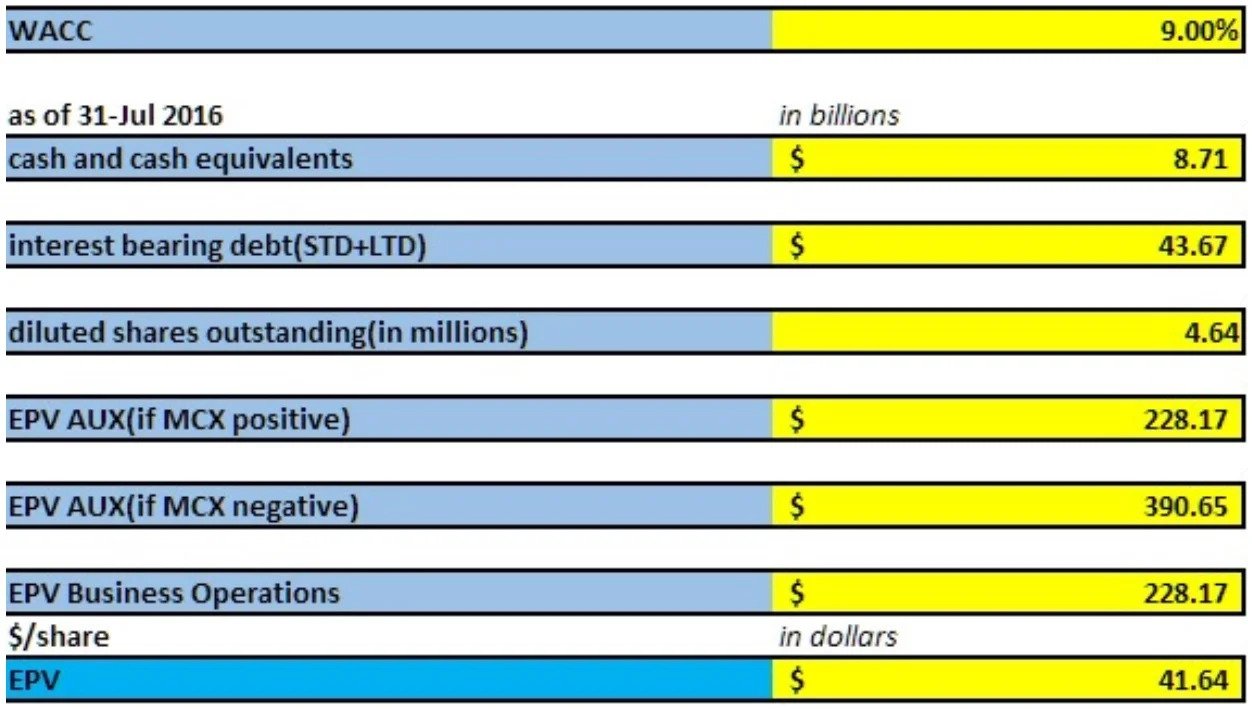

To fund a company you need capital provided by equity and debt investors. WACC (Weighted Average Cost of Capital) is a weighted average between debt, common and preferred equity that will result in a percentage of the cost of capital.

As an investor, you ask yourself: “It costs this to finance this project and the return I will get is this.”

Based on this and other metrics the investor decides to go ahead or not. At the time of our valuation, Walmart’s WACC in July 2016 was 9%. So this means that in order to raise capital to start

Walmart at that time the cost was 9%

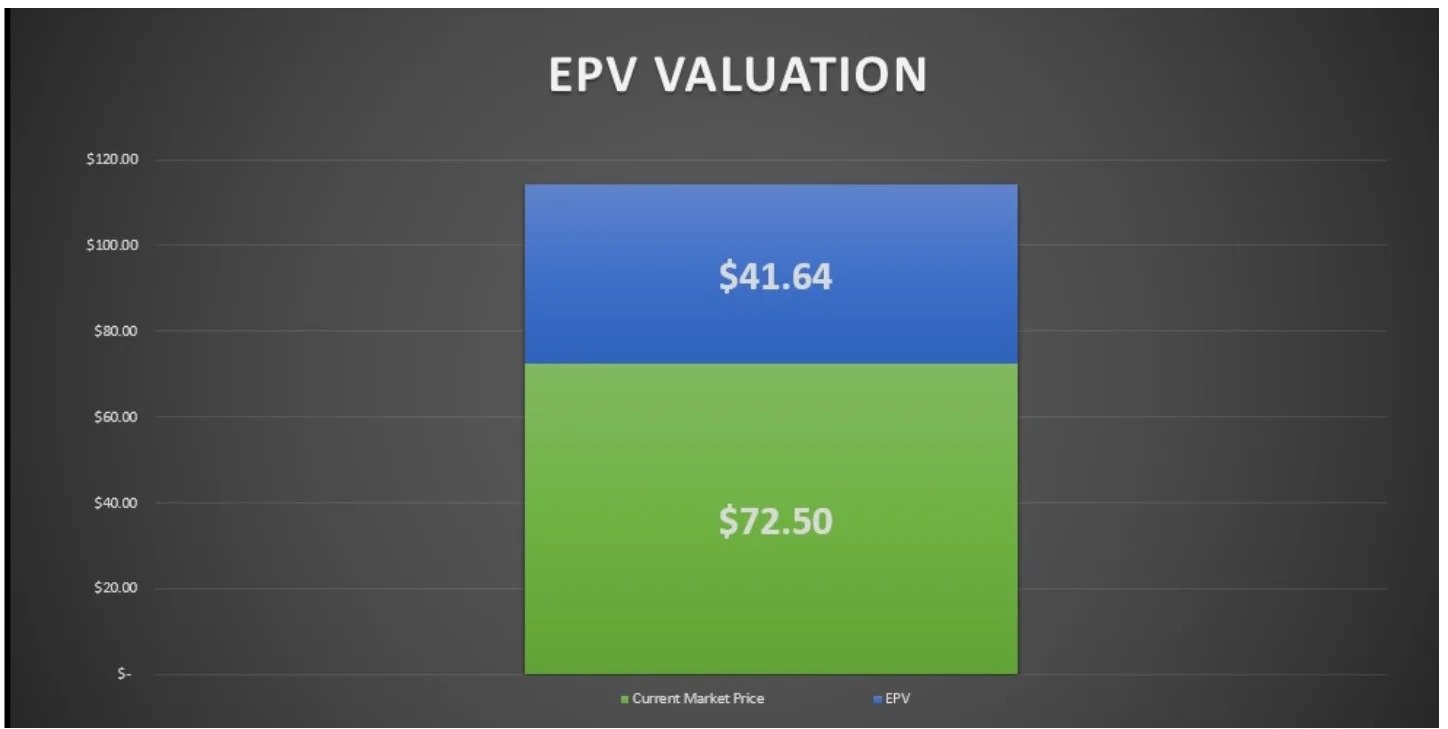

The next step is to check the price we came up with against the present market value.

Note that when you are studying an investment you must define your margin of safety, and you always want to define a certain margin beforehand.

It is basically you saying to yourself: “This investment is worth “x” price, so just in case I am wrong, let’s define a value below that so we can have a safety net below the valuation assessment”.

In our valuation, we arrived at the value of $41.64 per share. If you define a 30% margin of safety below this arrived intrinsic value this means you wouldn’t pay more than $29.15 per share.

But in this case, it does not apply because the stock is currently overvalued.

So to conclude our Walmart valuation: If you want to buy a company like Walmart with all the stores, employees, inventory, and so on, you would need to pay $72.5 per share today and the company is not worth more than $41.64 or $29.15 per share with your margin of safety.

Happy investing.

Very good write-up. I certainly appreciate this website. Keep writing!