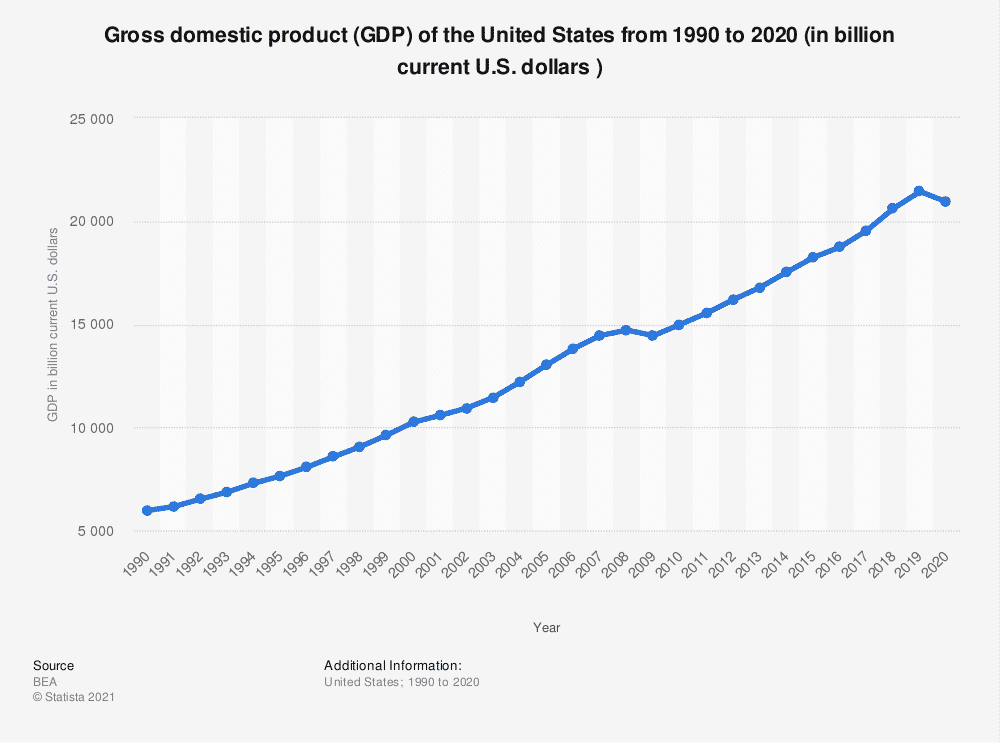

What is the Gross Domestic Product (GDP)?

Gross domestic product (GDP) is the monetary value of the total output of a country. Both nationals and foreigners count: besides a national company, it can also be a foreign factory within a country – it is also counted.

Not to be confused with GNP. Gross National Product (GNP) is everything produced by a country’s owned businesses, no matter if they are outside of the country’s borders. A good example is Japanese car factories situated everywhere in the world. This is counted in Japan’s GNP.

GDP is the monetary value of the total output of everything that was produced within the borders of the country – foreign or national.

How do we calculate the GDP?

There are three ways of calculating the GDP:

1. Expenditure Approach

2. Income Approach

3. Production / Output Approach

Expenditure Approach

This is the most used way to measure GDP.

GDP = C + G + I + NX

C: Consumption, G: Government Spending, I: Investment, NX: Net Exports. The final value of the GDP is in the country’s currency.

Consumption is literally all spending done by individuals: from a laptop, to groceries. It’s every single registered transaction from an individual fiscal number.

Government Spending is what the government spend during the period on public infraestructures, wages, a fleet of cars for government officials.

Investment spending is done by business: buildings, inventory and so on.

Net Exports is the difference between X – Exports and M – Imports.

If the country exports more than it imports, we way they run a rtade surplus. If the country imports more than it exports we say it is running a trade deficit.

We can see the Net Exports balance on the Balance of Payments of a country.

Income Approach

GDP = National Income + Capital Consumption Allowance + Statistical Discrepancy

Production (Value Added) Approach

Here, the idea is to calculate an industry’s output and subtracting it intermediate goods and services consumption. A car company uses materials and service providers to produce its cars.

So to measure the total output of the automotive industry we subtract its intermediate consumption.

What is the difference between Nominal GDP and Real GDP?

Now that we have an idea of what the GDP is, Economists use two ways of calculating it: the Nominal GDP and the Real GDP.

The Real GDP is stripped from the inflation value using the GDP deflator.

So to summarize:

GDP is the monetary value of all final goods and services produced in a country’s borders within a certain period, usually one year.

Nominal GDP – measures this value using current prices and current year’s quantity of output.

Real GDP – measures this value using the prices of the base year and the current year’s quantity of output.

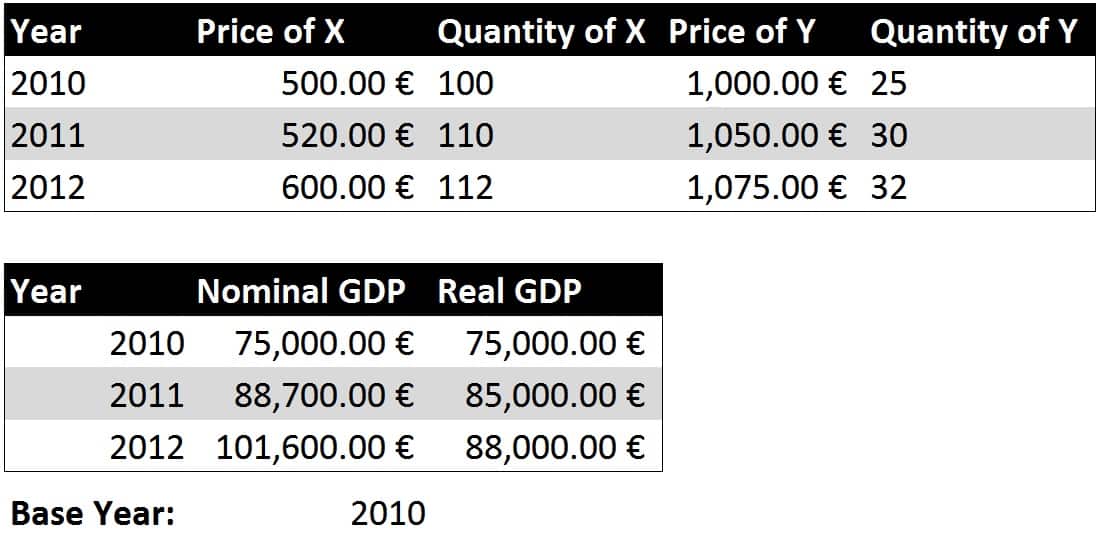

GDP Calculations

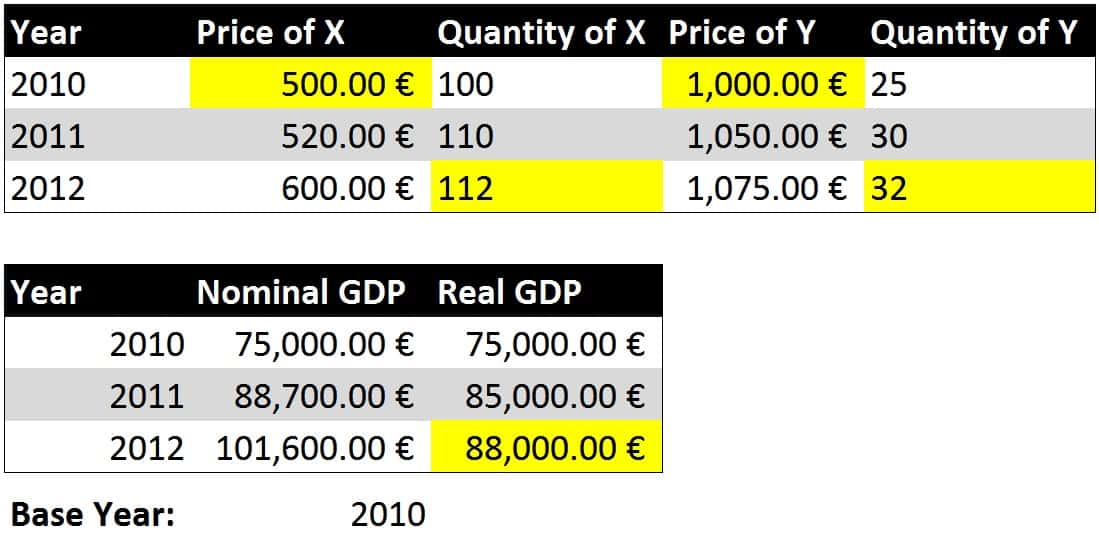

Both GDP calculations start off with the same base year:

500 € x 100 + 1,000 € x 25 = 75,000€

Nominal GDP Calculations

Nominal GDP keeps going by row, meaning each year is the current price x current quantity:

2011: 520 € x 110 + 1,050 € x 30 = 88,700€

2012: 600 € x 112 + 1,075 € x 32 = 101,600€

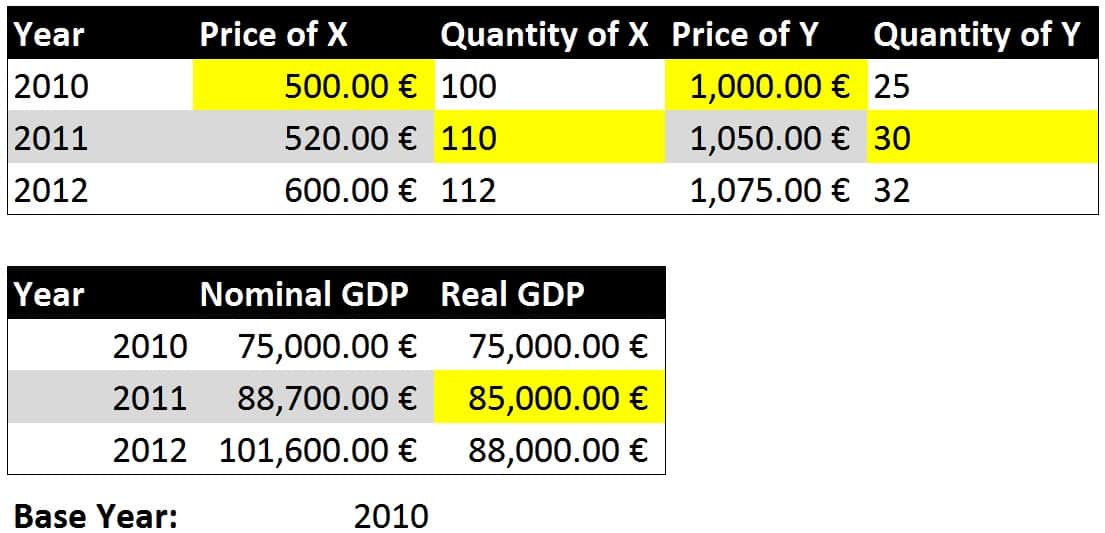

Real GDP Calculations

Real GDP uses current year’s quantity but base year’s prices:

2011: 500 € x 110 + 1,000 € x 30 = 85,000€

2012: 500 € x 112 + 1,000 € x 32 = 88,000€

GDP Deflator

To calculate de GDP deflator just divide the (Nominal GDP / Real GDP) x 100

So let’s say you want to know the GDP deflator for the years 2012:

Deflator 2012 = (101,600 / 88,000) x 100 = 115.45

What does this mean?

It means that if you had the Nominal GDP for the year 2012 and its deflator and wanted to know the Real GDP you would divide 101,600€ by the deflator 1.1545 to get the 88K€.

Notice that I took off the 100 that is usually multiplied to present the GDP. I used 1.1545 instead of 115.45

Note also that since in the base year, the same year’s prices and same years quantity is used, when you divide the Nominal GDP by the Real GDP you get 100 as the deflator. So remember, the Deflator for the base year is always 100.

GDP Inflation Rate

Another thing we can do with the deflator is find out the GDP Inflation rate. Think about it: if the base year starts at 0, any increment after that will give you the inflation rate.

GDP Inflation Rate from 2010-2012 = (115.45-100) / 100 = 15.45%