What is the Loanable Funds Market?

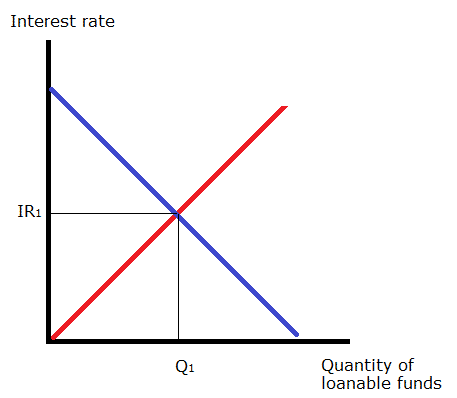

The loanable funds market represents the interaction of borrowers and savers in the Economy: Borrowers demand loanable funds and savers supply loanable funds. The market is in equilibrium when the real interest rate has adjusted so that the amount of borrowing is equal to the amount of saving.

The key here is remembering that borrowers demand and savers supply. This happens because someone’s spending is another person’s income. And to expand, the economy borrows, so the demand for loanable funds goes up.

The equilibrium point has two coordinates(quantity of loanable funds being borrowed and the Real Interest Rate being charged). This is where all funds supplied are being borrowed.

Like all demand and supply economical models, there are situations that cause shifts in the curves. Let’s look at these in more detail.

Demand Curve Shifts to the right

Increase in Business Confidence – Shifts the Supply Curve to the right. This Increases IR and Q. The expected rate of return on investment increases when businessess are more confident on the economy.

An example of this is expansionary fiscal policy, when the Government decreases taxes to stimulate the economy.

Another example are technological advancements that increase extepcted return on investments.

Tax Credits – A tax credit like the Portuguese SIFIDE II, provides an incentive for businesses to invest. This increases the demand for loanable funds, shifting the demand curve to the right, increasing the Quantity of demanded loanble funds and the real interest rate.

A GOVERNMENT OOPSIE!!!

A particular situation that happens here when the economy is in expantion more is called Crowding Out.

What is Crowding Out?

This is a situation where government spending drives down consumer spending. As government borrows to finacne projects like roads and other projects, interest rates go up and this causes less demand from businesses as interest rates become prohibitive, hence causing a downturn in the Economy.

Demand Curve Shifts to the left

A bearish outlook in the economy – if the economy is contracting, investor lose confidence in the advancement of the economy, so they pull back on investment. As a result, the demand for loanable funds decreases.

Supply Curve Shifts to the right

Rise in Disposable Income – When disposable income rises, consumers, spend more but also save more. Higher savings means the increase in supply of loanble funds.

Decrease in the deficit – When the government cuts back on spending, they are decreasing the the deficit and hence increasing loanable funds.

Foreign Investment in another country – If foreign investors invest in a stable country the loanable funds supply is being increased, hence shifting the supply curve to the right.

Supply Curve Shifts to the left

Rise in Interest rates in other countries – this causes financial capital to flow out seeking higher interest rates. Low relative interest rates causes foreign investors to pull their money out of the country. This decreases the supply of loanable funds, shifting the supply curve to the left.