What is the Money Market Model?

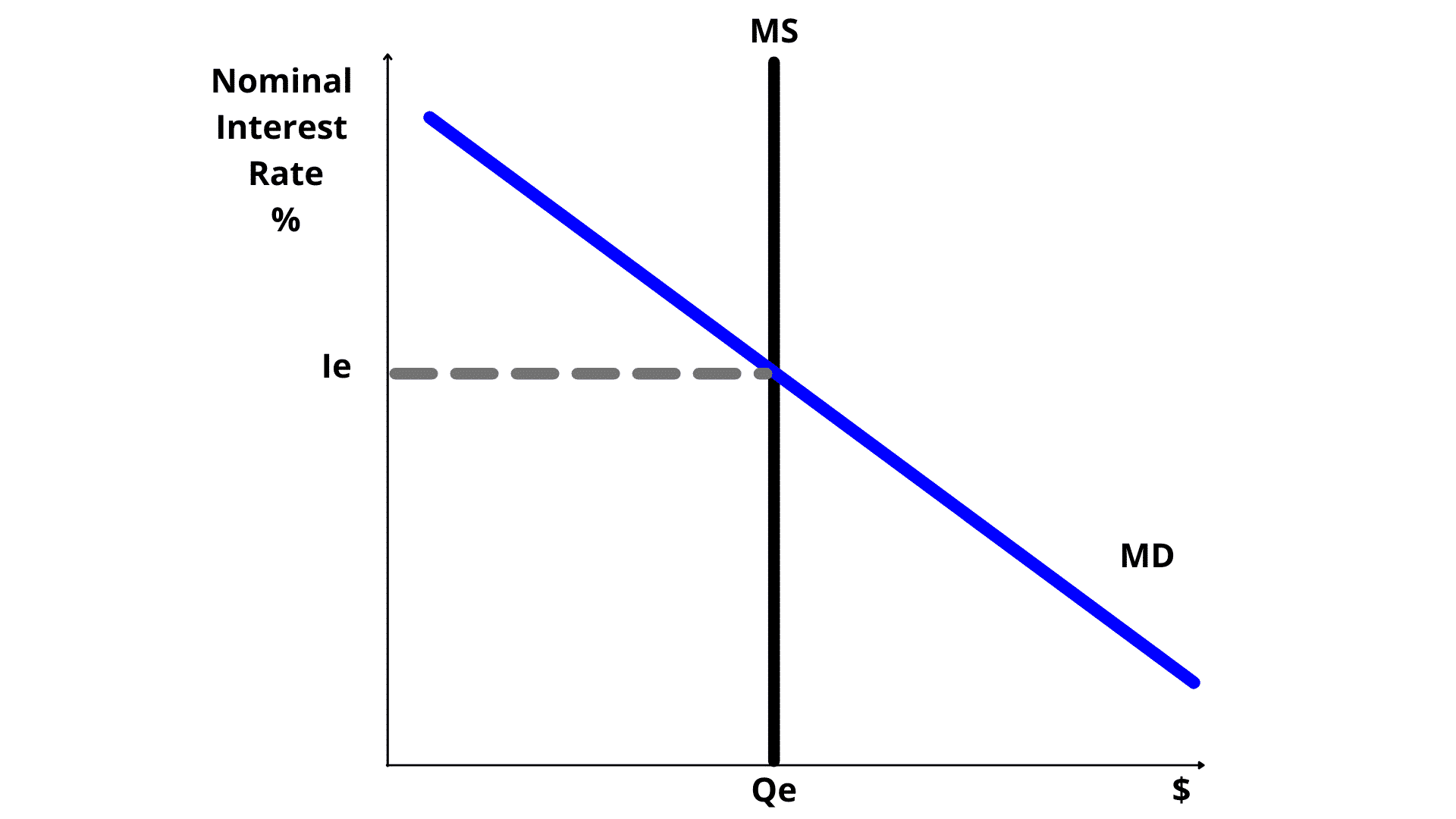

The money market model shows the relationship between the quantity of money being supplied when there are changes in the nominal interest rate.

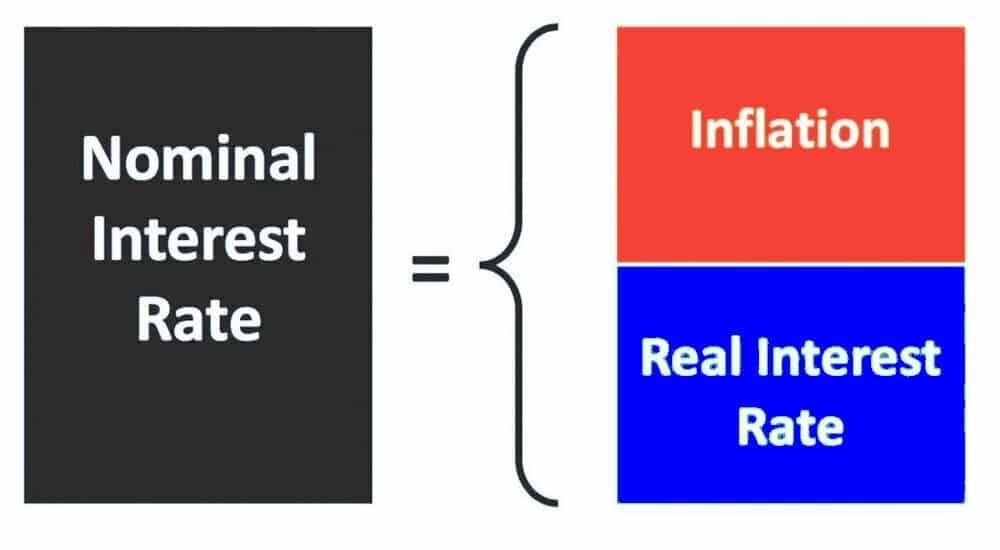

The Nominal Interest Rate is the real interest rate before adjusting it inflation. To know the real interest rate, you just subtract the inflation rate from the nominal interest rate.

Now that we have that out of the way, what about the other components of the graph?

The Money Demand is always a downward sloping curve.

The Money supply curve is always inelastic.

Both curves can shift given changes in the AD/AS model.

Money Demand

Money is demanded under two scenarios:

1. As a medium of exchange between transactions – a truck costs $100.000. You give the company $100.000 they give you the truck. This is called Transaction Demand for Money.

2. As a way of storing wealth – You loan it out to a company to get paid interest on it for instance. So if you have more money and at an interest rate where you can charge above it, and you have people asking for loans, you are in business. This is called Asset Demand for Money.

Money Supply

Money is controlled by the Federal Reserve, or FED to its friends. In order to stabilize the inflation level, the FED conducts what are called Open Market Operations with the objective of lowering or increasing the interest rate level.

When the Price Level is higher, people buy less, when the Price Level comes down, people buy more.

These Open market operations are part of what is called the monetary policy and these operations can be expansionary or contractionary.

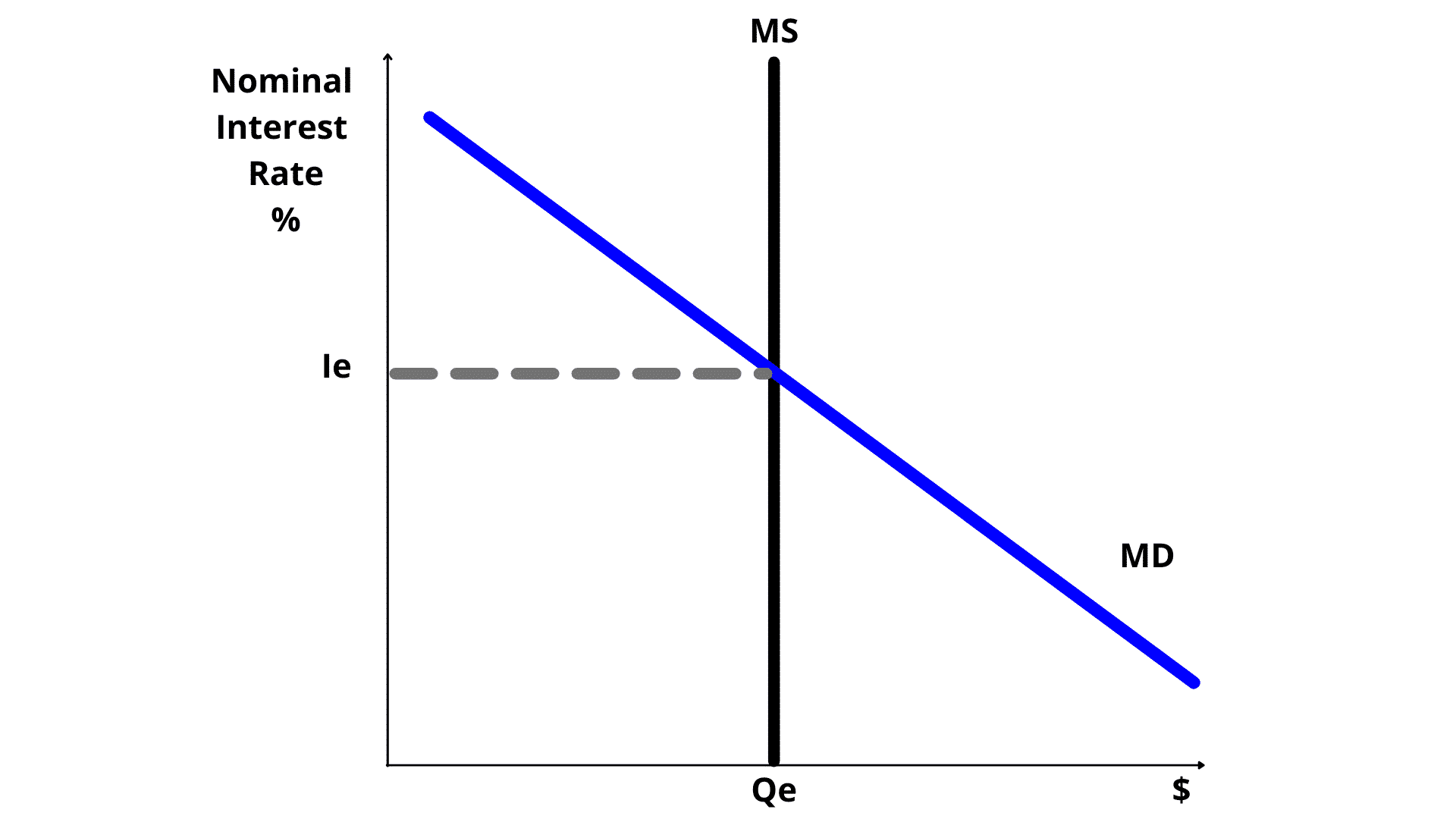

When the FED increases the money supply this is an expansionary money policy and shifts the Money Supply Curve to the right, lowering the nominal interest rate.

When the FED decreases the money supply this is a contractionary money policy and shifts the Money Supply Curve to the left, increasing the nominal interest rate.

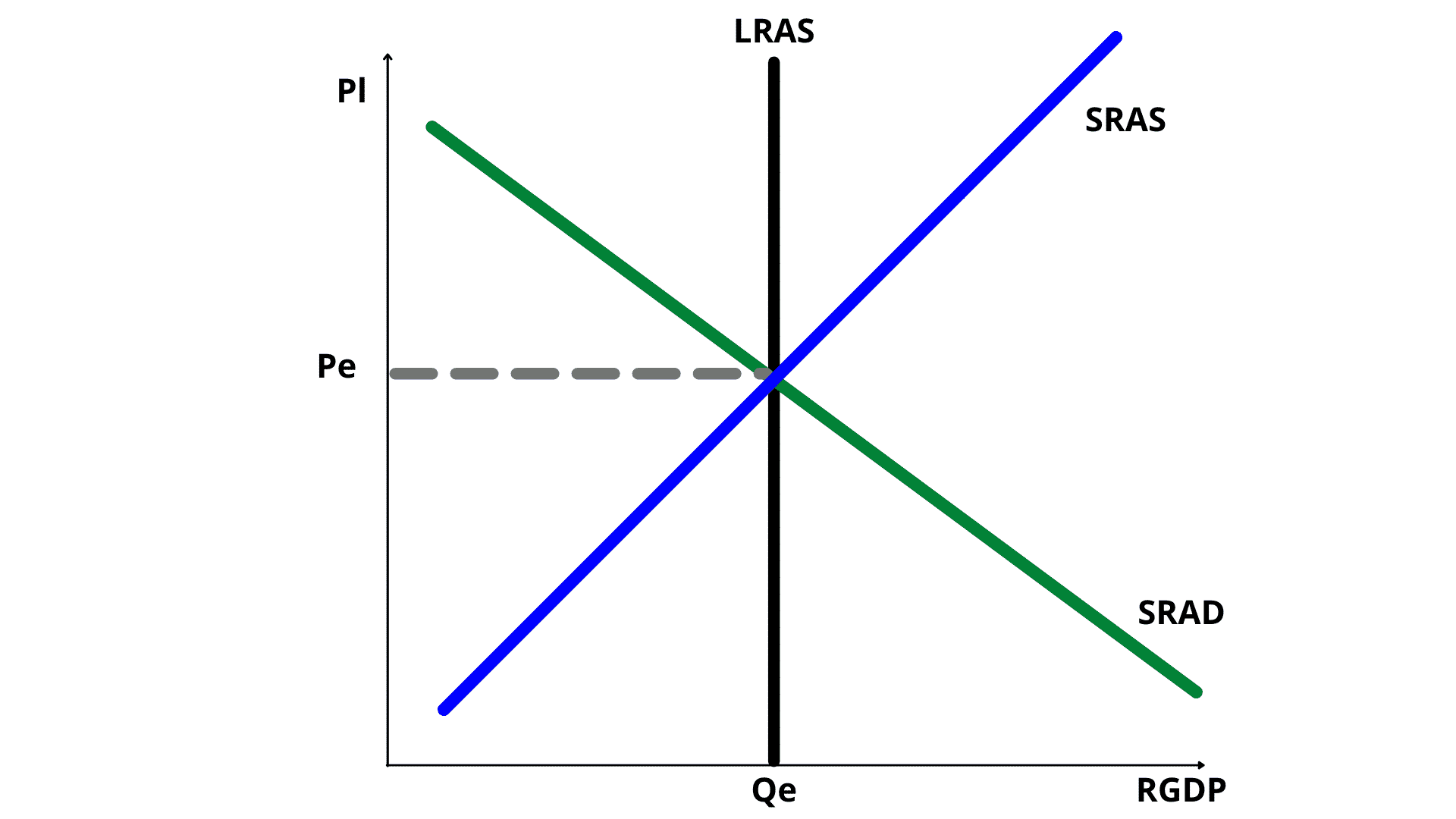

What is the relationship between the money supply and the Real GDP in the AD/AS model?

When the FED increases the Money Supply, this is an expansionary monetary policy: by lowering the interest rate, it stimulates the increase in demand as prices are lower. Consumers demand more, so the Short Aggregate Demand Curve shifts to the right, stimulating a growth in the Real GDP.

When the FED decreases the Money Supply, this is a contractionary monetary policy: by increasing the price level, it causes a decrease in demand. Consumers demand less, so the Short Aggregate Demand Curve shifts to the left, decreasing the output of the Real GDP Quantity.

Remember that because of the Monetary Policy changes, this has the effect of causing changes in any of the components of the GDP (C+I+G+(X-M)), which in turn causes the Short Run Aggregate Demand Curve to shift.