Is the Trade Deficit a Problem or Not?

The US is the prime Economy of the world. It seems odd at face value that they would be one of the largest debtor nations in the world. In this article, we will go through this so we can get to some conclusions.

So what is a Trade Deficit?

In our last article, we went through the country’s GDP = Gross Domestic Product. Essentially, all output of a country’s output in its borders, usually measured in a time period: usually around one year.

There are several equations for the GDP, one of them is the expenditure’s approach where: GDP = C + I + G + (X-M)

Another way o stating this equation is as follows:

(I – S) + (G – T) + (X – M) = 0

(I – S): private sector balance

(G – T): public sector balance

(X – M): foreign sector balance

A trade surplus happens if the X (Exports) is larger than the Imports (M) and a trade deficit happens when a country imports more than it exports.

At the time of this writing, the US Economy has a U.S. trade deficit was $676.7 billion, according to the U.S. Bureau of Economic Analysis (BEA).

The U.S. imported $2.8 trillion in goods and services and exported $2.1 trillion. But why?

GDP vs Trade Balance

You might hear that the US is running a trade deficit and that this is bad for them and the overall economy, but they are not running a negative GDP. They are just outsourcing more products from outside countries than producing these nationally.

They can afford this because the other components of GDP are positive.

It’s like buying an investment property. you don’t buy it 100% on cash, you finance it at a LTV of say 75% and get income from the rent. Technically you have debt on the house, but has long as you have income coming from it, that is higher than the debt service to paid to the bank, it is a cashflow positive project.

Here is the same thing: just because the trade deficit is negative it doesn’t mean the US GDP is negative.

In fact, the US runs a trade surplus in services and has a much higher GDP than China.

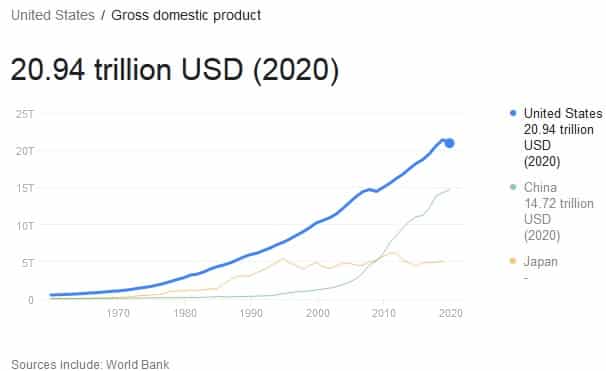

In 2020, both countries GDP numbers were as follows:

US GDP = $20.94 Trillion

China GDP = $14.72 Trillion

So clearly the US is a productive country and the overall trade deficit theme under this scenario is overstated.

Job Loss from the Trade Deficit

Another argument that we hear that is related to the negative trade balance is in regards to unemployment.

Studies have been done to check this and it is a false statement. If there is a trade deficit, and apparently only in products, not services, this means that companies in the US outsource building products in China, because they see them with a comparative or even an absolute advantage doing that, so the question is what happens to US workers that could be employed doing the product?

The answer they find a job doing something else.

Remember that the US runs a trade surplus in services, this means that there are service providers like lawyers, engineers, economists and all sorts of professions that don’t necessarily involve manual labor. And these professionals are getting paid from outside capital, otherwise the US wouldn’t be running a services surplus.

Which countries does the US do more trade with?

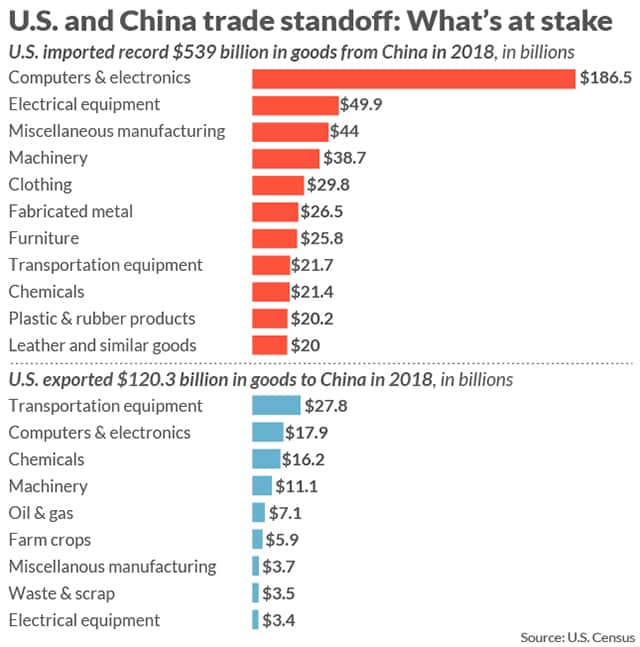

By looking at the graph it is clear that China represents a significant part of the US trade balance. So, why does this make any sense at all?

Does China have something no other country in the world has?

If so, can they produce it at a much lower cost?

If you recall from our talks about comparative advantage and absolute advantage, the whole point of trade is for both parties to benefit from the transaction.

So given that you can’t be everything to everybody, you need to specialize in something. That way two paths will develop and they can benefit from each other: an architect can benefit from a structural engineer and so forth.

In a study from the NBER(National Bureau Of Economic Research), they studied China’s local comparative advantage.

They found that :

1. ” China’s trade pattern is influenced not just by its overall comparative advantage in labor intensive goods but also by geography. “

2. ” China has a comparative advantage in heavy goods in nearby markets, and lighter goods in more distant markets”.

Essentially, US companies use China to manufacture its goods at a cheaper cost of labor, rather than themselves to it with US citizens.

But China doesn’t provide lower cost of production only. They themselves have better products in some categories. In fact if you look at the breakdown of products being bought by the US from China, the largest category is Computers & Electronics.

On thing to note here is that, out of the Computers & Electronics category, not all are finished goods. A good chunk are intermediate goods. These are computer parts, components and all that the US imports to finish the final product.

So China by supplying to the US, started to increase its production, having a larger Export volume than Imports. This would at face value, make its currency appreciate against the country that is buying and having its exports price becomeing more expensive.

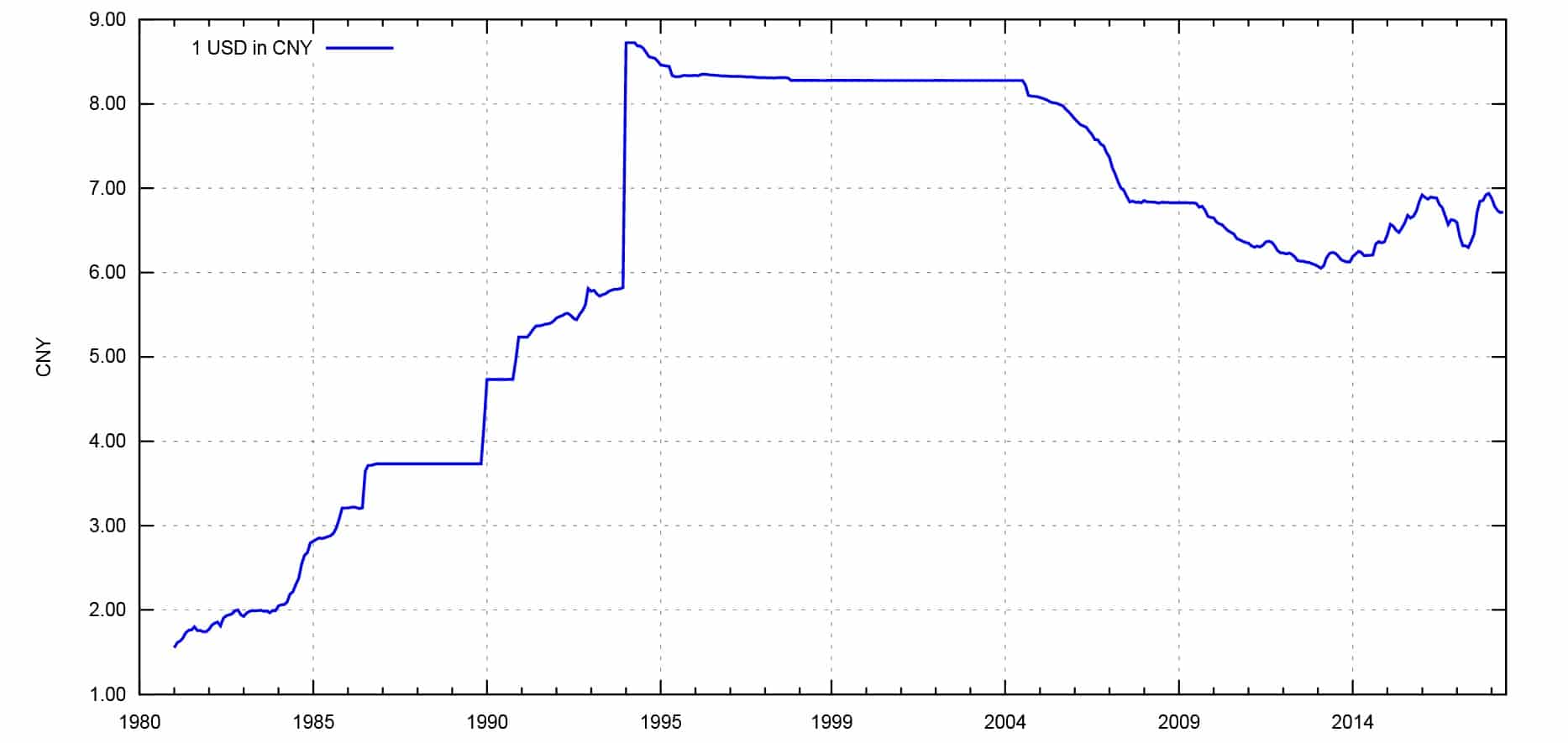

So in order to solve this, China has been devaluing its currency against the dollar, so that they can keep prices between their trade relatively stable.

For most of its history, the RMB was pegged to the US Dollar with a substantial devaluation, keeping prices artificially low. The Dollar can rise, and the RMB rises as well but since it is pegged at a certain Exchange Rate, prices from one Country to another are relatively stable.

There have been some points in History where teh peg was lifted, like in 2005, but this had the consequence of making the RMB more expensive against other countries that import from China, so they re-pegged the currency again, just not fixed but in a recime called managed float, shere teh the currency floats around a narrow band in comparison to another basket ot currencies.

This is done by government or central banks intervention where they buy and sell currencies to maintain a certain range.

Enter the Purchasing Power Parity (PPP) & The Big Mac Index

These operations are intended to stabilize what is called the purchasing-power parity (PPP). This is the concept that in the long run exchange rates should move towards the rate that would equalise the prices of an identical basket of goods and services in any two countries.

The whole idea here is finding out, given a level of purchasing power of an individual, how much goods can he purchase in his home country and the same basket in other country.

Alongside this concept The Big Mac Index was created. This index, which first appeared in the Economist magazine in 1986, tracks the purchasing power parity (PPP) of countries’ currencies and their real value against the dollar through the use of the Big Mac.

So let’s say in the US, with $1,000, he can buy x amount of goods. We need to ascertain what is the correct floating exchange rate that can applied between both countries, so that if he uses the same dollar amount he can buy the exact same number of goods in Portugal.

If the price in Portugal to buy the same amount of US goods is €1,500, this means that the Floating Exchange Rate of $1.00 is €1.50

Now let’s say inflation caused the EU basket of Goods to go up in price from €1,500 to €1,750. using the Stated Nominal Exchange Rate of 1-1.50 does not reflect Purchasing Power Parity as a US Citizen can no longer buy the exact same number of goods in Portugal. He is €250 short to buy the remaining basket of goods and services, making the USD undervalued against the EUR.

So, governments and central banks engage in activities that inflate / deflate its currency in order to maintain more stables prices for trade purposes.

In order to control the money supply, the U.S. Federal Reserve, conducts in what is called market operations. The main idea here is to control interest rates. If consumption goes up and prices go up as a result, this will eventually lead to an inflation rise, causing unemployment as prices are too high for people to buy anything and keep their lifestyle, so the FED puts a break in the Economy by increasing interest rates. In this way money is more expensive so people borrow less.

To do this, when the Economy is overheating, the Fed sells US bonds in the market, to essentially reduce the money supply, bringing interest rates down.

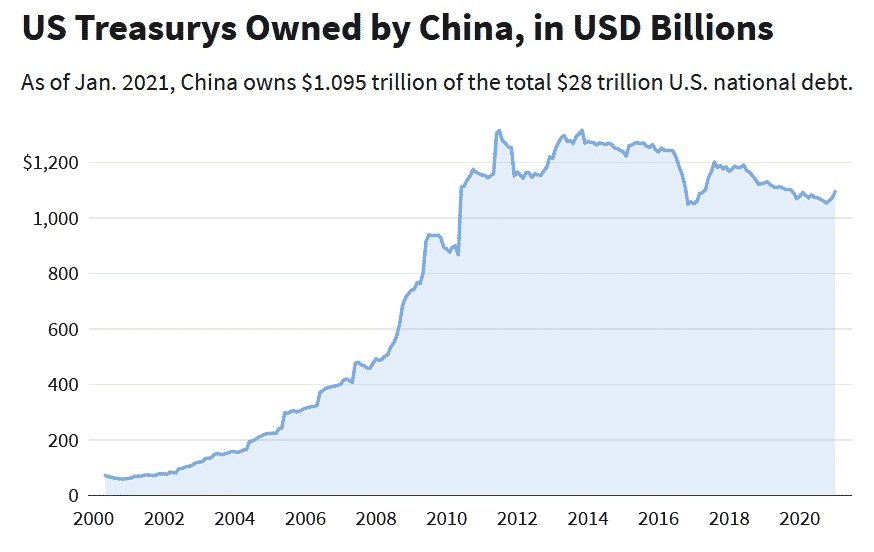

Why does this matter? Because the countries that buy most US Bonds are the countries that the U.S engages with more trade, namely China.

As of the time of this writing, China holds $1.095 trillion, or about 4% of the $28 trillion U.S. national debt, having an enormous claim on US.

Impact of China Buying U.S. Debt

One could ask: What if China sells all its IOU’s from the US in the Market? What would happen?

As long as a supplier keeps trusting the company to pay the bills within 30 days time, they will continue to do business. This is especially true when a supplier works for a large company. Here is not that different: as long as the US continues to have a good financial capability to pay its interest payments on time from its Treasury Bills, China will continue to buy these and in turn keep its currency artificially low to allow trade to keep going.

If they stopped selling to the US, China would have unemployment increase as the US wouldn’t buy from them. On the other hand, if they also increased their exchange rate, this would make their exports less competitive, and people countries would buy less from them.

So by keeping this arrangement, China is building a trade surplus, get paid from supplying the US its products and keeps pilling up US Bonds. In this way they keep getting their interest payments and keepssupplying the world with their products and services at a competitive rate. Everybody seems to be winning.

If the FED keeps printing money, can the U.S. Economy go into Hyper Inflation?

The answer to this question is a bit of a cautionary tale.

If the money supply is not supported by economic growth, then yes, but for the U.S it is not the case. The U.S is a productive Economy so it is unlikely that this can happen as they keep paying their interest payments on the bonds sold in the open market.

The U.S. is the largest customer to China and other countries, so they don’t gain by letting the dollar collapse.

If they are doing business together why the Trade Wars?

The U.S. and China although in an economical “partnership”, they are also engaged in harming each other from an economical standpoint. They do this by imposing tariffs on one another products. Tariffs are a tax but only charged the products that are produced outside of a country and are being imported.

Countries do this to make end-consumers and business import less of that product and stimulate purchasing of the same product within the country.

On July 2018, the U.S. imposed a 25.0% Tariff on $34 billion worth of Chinese products. As an example, President Trump justified tariffs on aluminum and steel based on national security concerns.

Likewise, China has also increased its tariff on U.S products. As an example, China as imposed high tariffs on American exports of soybeans. This is an enormous market the farmers in the Midwest grow only to sell to China.

So, they are butting heads on this matter, and this ends up harming both the consumer and businesses in both countries, as they are willing to purchase more at world prices, but won’t because of the tariffs.

The HUAWEI ban

Huawei is a private Chinese Cellphone and Telecommmunications company. As of May 2020 they were the largest cellphone producer in teh world with over 20% market share with almost double the size of Apple.

But they have since then been on a nose diving spiral due to the campaigns from the U.S., most notably due to pressures from former President Donald Trump and continuing with Biden for all U.S. companies, banning them to provide semiconductors to Huawei as they rely heavily on U.S. semiconductors to build their products. Since Huawei doesn’t produce its own semiconductors, this has caused them to cut production, so their sales started to plummet.

Huawei become the main telecommunications company in China.

Founded in 1987 by Ren Zhengfei, an enptrepreneur with connections to the Chinese Military. At that time all Chinese communications equipments were being imported from other countries, and were very dependent on them.

To solve this problem, Ren started to reverse engineer their products and started building them by themselves. They started to get better and became the most advanced telecommunications company in China. As a result, they startet to get more and more government contracts and substantially had more influence as we all know, business is done by relationships, so the Chinese government was on board with Huawei.

As the government didn’t want foreign companies coming in to the country and since Huawei was doing so well, they gave them preference, helped them with capital spirces so Huawei could continue developing their operations.

Huawei kept investing in Research & Development and around the 2000’s they were developing state-of-the-art products with advanced technologies unparalelled by any other competitor.

They started to get awarded contracts from telecommunications companies all over the world and quickly became a Fortune 500 company.

In early 2020 they surpassed Samsung to become the largest handheld cellphone maker in the world.

Due to this massive world domination in the space, the Trump administration signed a bill banning government use of Huawai telecommunications devices, based on the premise that this Chinese company could use its devices to spy on Americans.

To fight this, Huawei went to the point of providing access to their source code so that programmers could check if there was any code with that purpose. Nothing was found. Nonetheless, Trump’s administration and then Biden’s kept to this line of action.

The U.S. government didn’t just ban government use of Huawei’s technology, they also put the company on a blacklist, preventing them to do any business with U.S. companies without a license.

Due to allegations that Huawei had been providing equipments and services to awarded contracts to countries like Iran and North-Korea, the U.S. filled for the arrest of Huawei’s CFO Meng Wanzhou/the founder’s daughter).

Given the possibility that the Trump Administration could cripple their operations by completely shutting down their possibilities of getting chips, components and contracts with other countries, Huawei stock-pilled chips to be able to continue functioning, but this had the direct effect of hindering the company’s ability to produce and generate revenue.Before leaving office, Trump made a point of revoking all licenses to do business with Huawei.

It is clear that the only way Huawei is going to survive is to improve overall trade relations, completely cut ties with U.S suppliers and start making their own chips and missing components that they heavily rely on to make their equipments.

That way they can be independent from the U.S.

Can this mistrust between countries lead to the downfall of both?

So on one hand we have countries engaging in mutual economical business relations that improve their overall surplus, and on the other hand, they are also engaging in competitive practices to harm each other.

What can be the possible outcome of this?

This is my assessment, but I think the U.S. is in a vulnerable position in regard to China. Although this trade deficit from the U.S seems to be working right now in the short-term, I don’t think it is a good situation to keep on an ongoing concern as if both countries relationship deteriorates, they will try to harm each other with what they have available, and China has the upper hand on this one from my perspective as they keep growing and own U.S. debt.

On the other hand, China-based companies that rely on the U.S. can start getting undercut if there are dependencies from the U.S. in order to complete their products.

So to conclude: Trade?

Yes but with a grain of salt as if the other country starts seeing you as a competitor, they will try to undermine you as we have just seen with the Huawei situation

Is the U.S. trade deficit a problem?

Not at this point but it can be in the future. The U.S. is paying for products coming from China and when inflation rises due to over-consumption, the Fed sells China U.S. Bonds. China has a claim on the U.S. but it is also dependent on them to keep selling as the U.S. is one of their largest clients.

I have heard explanations from different economists, some in favor others against, others neutral. I think like all things in life, we need to come back to the basics: you spending more money than receiving a good thing? No. It is simple arithmetics. If you spend more than you get paid, you will go broke, no matter the scale, countries or individuals, the situation, the bells and whistles, and all economical gimmicks.

Conclusion

The solution is to improve productivity and independence so that in a situation where your “partners” turn on you, you are in a position of power. In the meantime, you keep working on the process until you reach that point.