What is the Balance Of Payments?

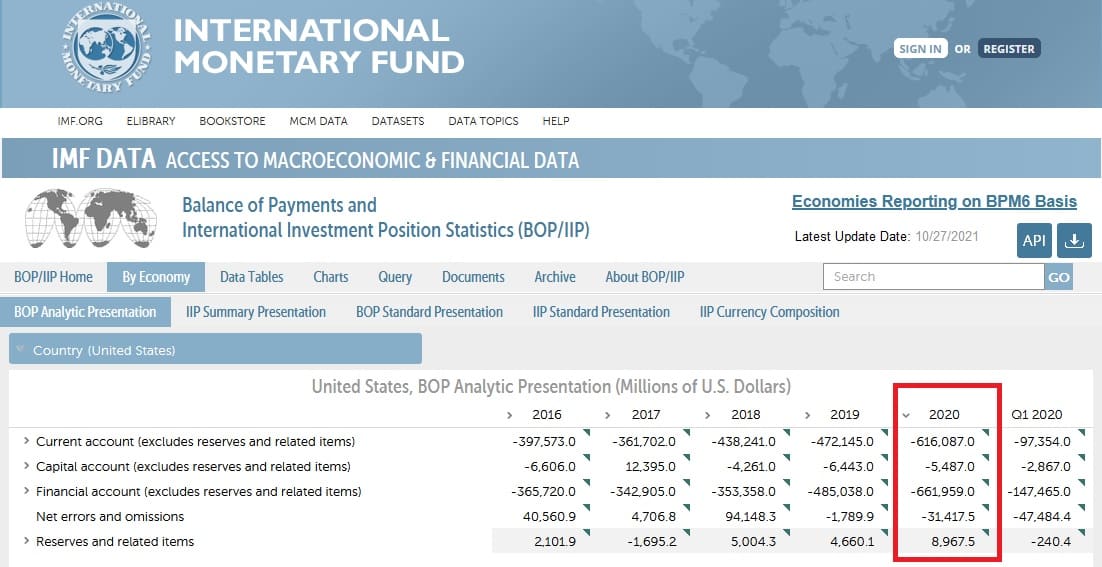

In Macro Economics, Economists measure inflows and outflows of money into and out of the Country. This flow is called the Balance of Payments. “Balance” because the inflow balances with the outflow.

The BOP has four main accounts:

1. Current Account

2. Capital Account

3. Financial Account

4. Reserves and Related Items

The two main ones are the Current Account that reflects the balance between inflows and outflows of money used for the payment of goods and services, and the Financial Account that has the same logic but reflects financial related transactions like stocks, bonds, shares and dividends.

The math here is pretty straight forward. Let’s look at the Current Account:

Goods, credit(exports) minus Goods, debit (imports) = Balance on goods

Services, credit(exports) minus Services, debit (imports) = Balance on Services

If the Country has a balance where it exports more than imports it is running a trade surplus, and if it imports more than exports it is running a trade deficit.

If this is related only to physical products, sometimes this is referred as BOT or Balance of trade. Whereas if it refers to everything it is called Balance of Payments of BOP.

Examples:

UK citizen buys stock in a US company

It is an asset purchase. The payment is counted in the financial account and since the money is flowing into the US, it is counted as a credit.

A Mexican mining company purchases US-made tractors

It is a payment for a capital good. The resources(tractors) are leaving the US so it is part of the current account. Since money is flowing in, it is a credit.

A UK citizen buys US Treasury Bonds

It is an asset purchase. The payment is counted in the financial account and since the money is flowing into the US, it is counted as a credit.

A UK citizen receives dividends from his US company stock

It is a payment for earnings on investments. Earnings on investments are part of the current account, and since the money is flowing out of the US, it is counted as a debit.

A US citizen buys Swiss Government Bonds

Bonds are a financial asset, so this payment is counted in the financial account. Since the money is flowing out of the US, it is counted as a debit.

A US investor buys stock in a UK company

It is an asset purchase. The payment is counted in the current account and since the money is flowing out of the US, it is counted as a debit.

A UK student in the US receives money from home

This is a money transfer so it is counted in the current account. Since money is flowing into the US, it is counted as a credit.

A US entrepreneur receives earnings from a factory he owns in the UK

This is earnings on investments so it is counted in the current account. Since money is flowing into the US it is counted as a credit.

US Citizens send money to a disaster relief fund in Haiti

This is a money transfer, so counted in the current account. Since money is flowing out of the US, it is counted as a debit.

A UK Citizen sells land to a developer in the US

This is an asset purchase. Since land can’t leave the UK, it is part of the financial account. Money is flowing out of the US so it is counted as a debit.

A US lawyer is paid by a UK company to do legal work

This is payment for a service that is part of the current account. Since money is flowing into the US it is counted as a credit.

Why do developed countries carry a trade deficit?

It’s mostly the US that does this if you compare this country to another behemoth of an economy like China who runs a trade surplus.

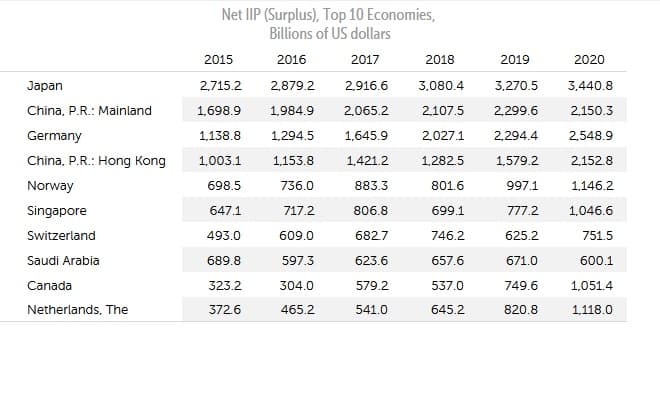

If you look at the top 10 list of countries that run a trade surplus, with the exception of the US, you’ll find the wealthiest countries in the world there.

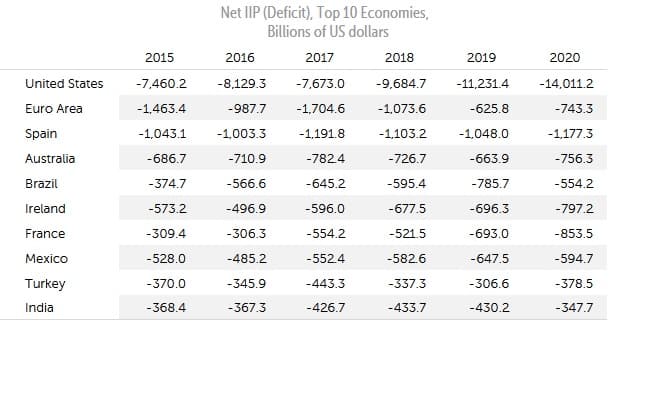

Whereas if you look at the top 10 countries that run a trade deficit you’ll find the US as the top of the list. This is a “glitch” in the Matrix given the US unique set of circumstances.

We will address this in another article.