What is Factor Markets?

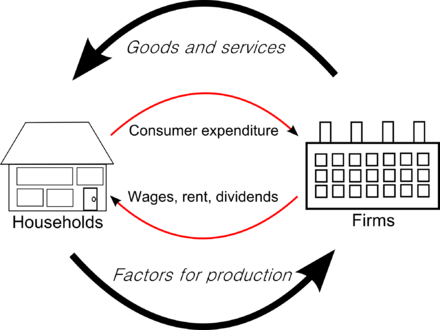

Factor Markets or Input Markets is the Circular Flow Model that we already addressed. This is the market where all the goods and services are sold:

1. Firms produce goods and services, households buy these.

2. To produce these goods and services, firms pay rent, wages and salaries, and households provide the factors of production( land labor and capital)

In this section we will focus more on the company’s reasoning for hiring labor.

The three types of Industry Sectors

We already talked about this, but let’s review as this is important. There are three types of Industry Sectors:

1. Primary – The primary sector of industry extracts raw materials or natural resources from the land: farming, mining, fishing or oil production.

2. Secondary – The secondary sector of industry manufactures, using the raw materials from the primary sector and converting them into new products: car manufacturers, food production or building companies.

3. Tertiary – The tertiary sector of industry provides services done by people to consumers or businesses: banks, supermarkets, coffee-shops.

Derived Factor Demand

Knowing the industry sectors, an important concept arises which is derived factor demand. Since resources are used in the production of goods and services, derived factor demand occurs when consumers influence the demand of one product as they want another. They demand a car. A car has tires, so the demand for rubber goes up. This effectively changes the demand curve for both rubber and cars to the right.

Marginal Revenue Product

The marginal revenue product of labor is the additional amount of revenue a firm can generate by hiring one additional worker.

Marginal Revenue (MR) x Marginal Product of Labor (MPL) = Marginal Revenue Product of Labor

In the beginning, there is an increased benefit to the firm to hire workers as the level of output increase significantly, but then due to the law of diminishing marginal returns, the slope of the curve keeps going down. The additional benefit starts going down until it reaches a point where firms won’t hire anymore workers.

Hiring Decisions in the Markets for Labor and Capital

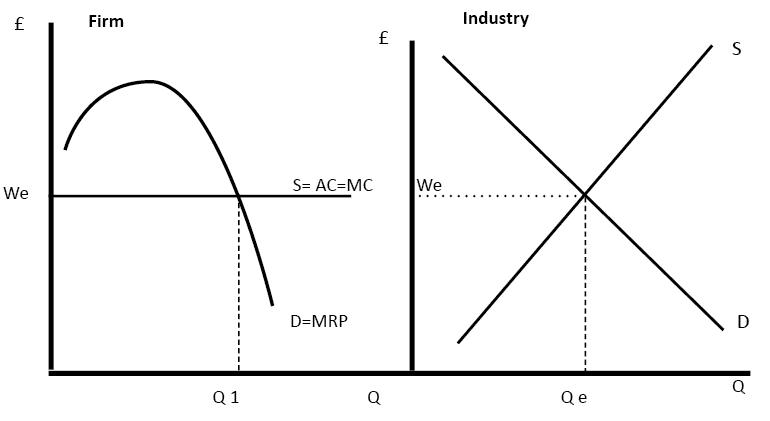

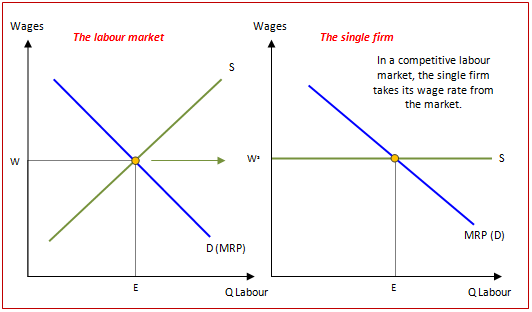

Perfectly Competitive Resource Markets

If a firm is operating in a competitive market, the wage per worker is set by the Market, and the firms will keep hiring as long as the Marginal Revenue Product(Demand – “D”) ≥ Marginal Revenue Cost(Supply – “S”)

Firms won’t pass this point, because it would take the firm to pay $10 to someone that generates $5.

Monopsony

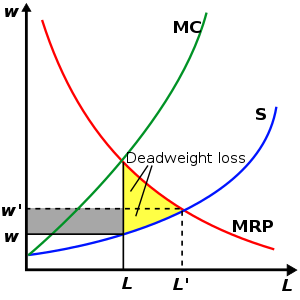

A Monopsony is a Monopoly for Labor. It is a Market without trade unions. In this situation there is only one firm hiring, and they are wage makers.

All firms hire the quantity of Labor where MRC(Marginal Revenue Cost) = MRP(Marginal Revenue Product).

How much are they going to pay? They are paying the amount workers are willing to work for, in this specific case where MRC = MRP and not where S = MRP. This creates a deadweight loss in the quantity of hired workers and also a wage decrease as the firms could pay at W’ but will pay at W.

Why does this happen?

Think about a company like Google or Microsoft or a Big Bank you would like to work for. You would be willing to get paid less because you are working for a firm like this and they have the means to pay you a higher wage.

So essentially a Monopoly has a Monopsony situation.

Market Distribution of Income

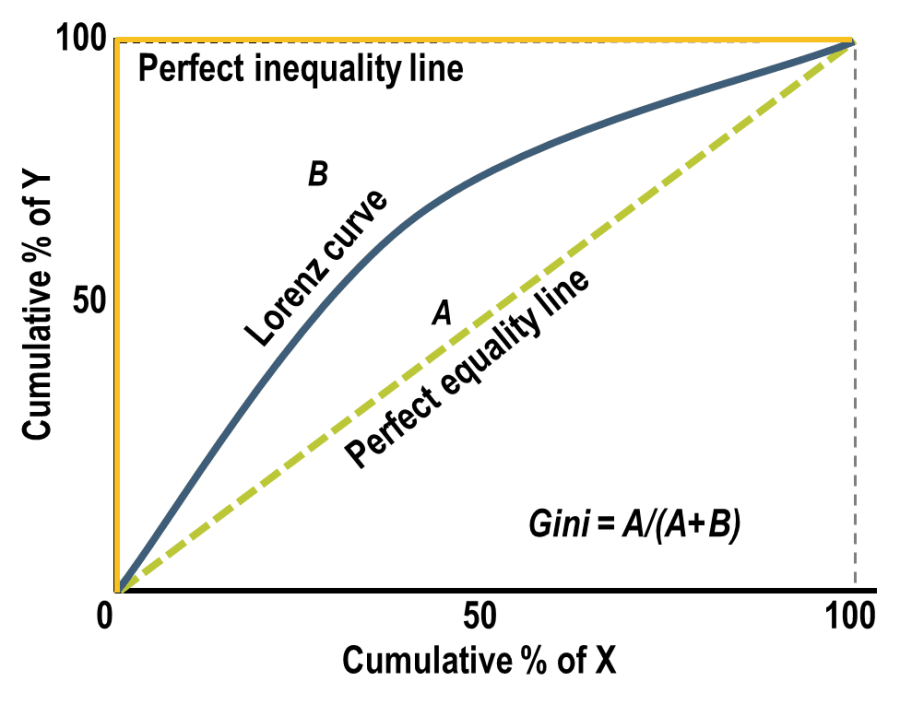

This concept addresses the Gini Index and the Lorenz Curve.

The distribution of Income in an economy is represented by the Lorenz Curve and the degree of income inequality is measured through the Gini Coefficient. The line at the 45º angle shows perfectly equal income distribution, while the other line shows the actual distribution of income.

In a perfectly equal scenario there wouldn’t be a difference between the Cumulative % of X in relationship to the Cumulative % of Y. But in the real world, top producers receive the top rewards and this segment of the population is much less than the majority.