What is International Trade and Public Policy?

International trade policy defines the standards, goals, and rules, and regulations of trade agreements between countries. A government establishes an international trade policy that defines actions to be taken in order to protect the best interests of its citizens and companies from its view.

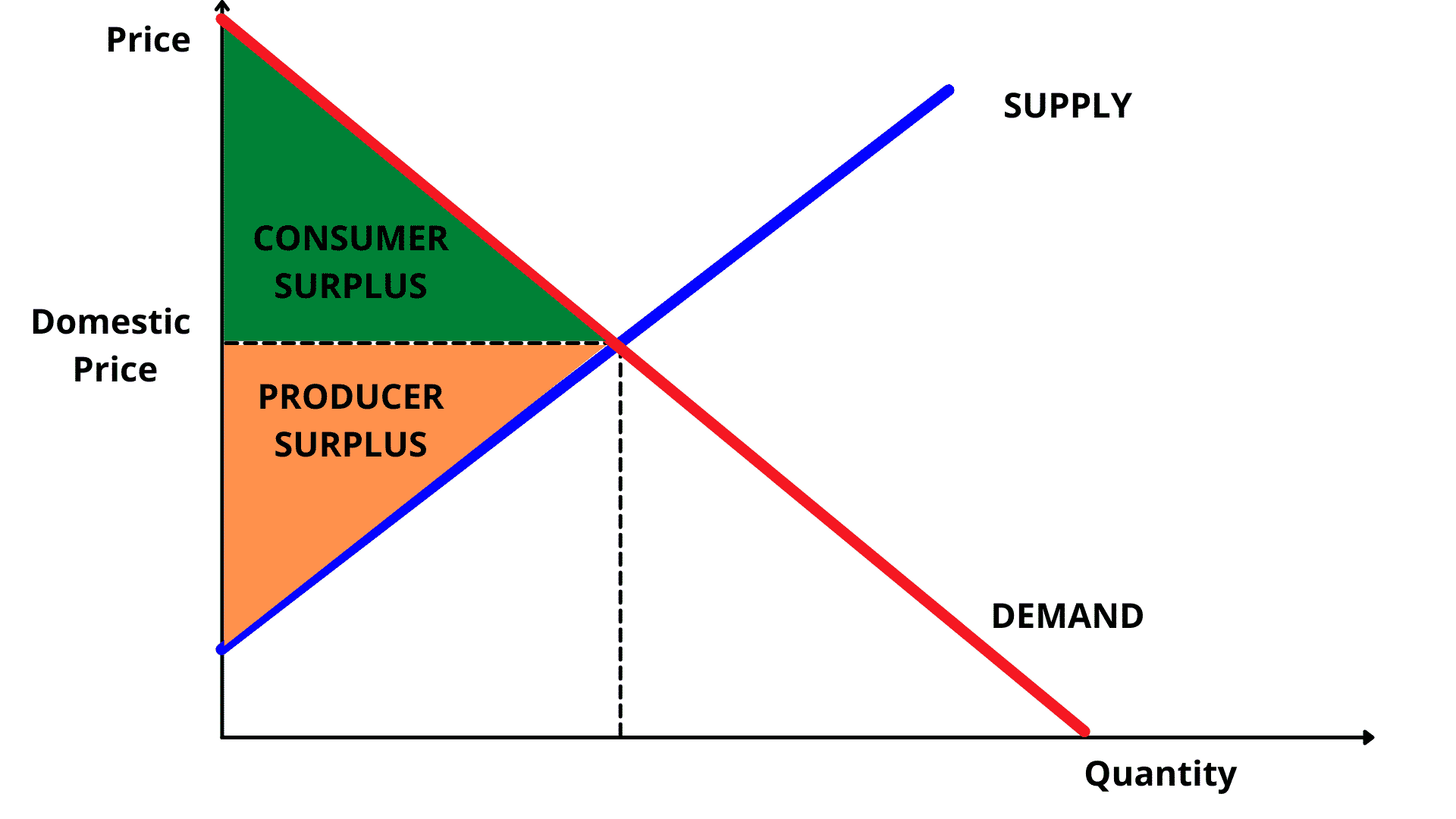

It is a cost-benefit scenario where from one hand, the government is liberalizing the economy to allow free trade between countries providing consumers the possibility to acquire the same good or service cheaper than if locally produced/provided, but on the other hand, also having a certain level of protectionism where they still want to benefit local producers by having consumers acquire from them as well.

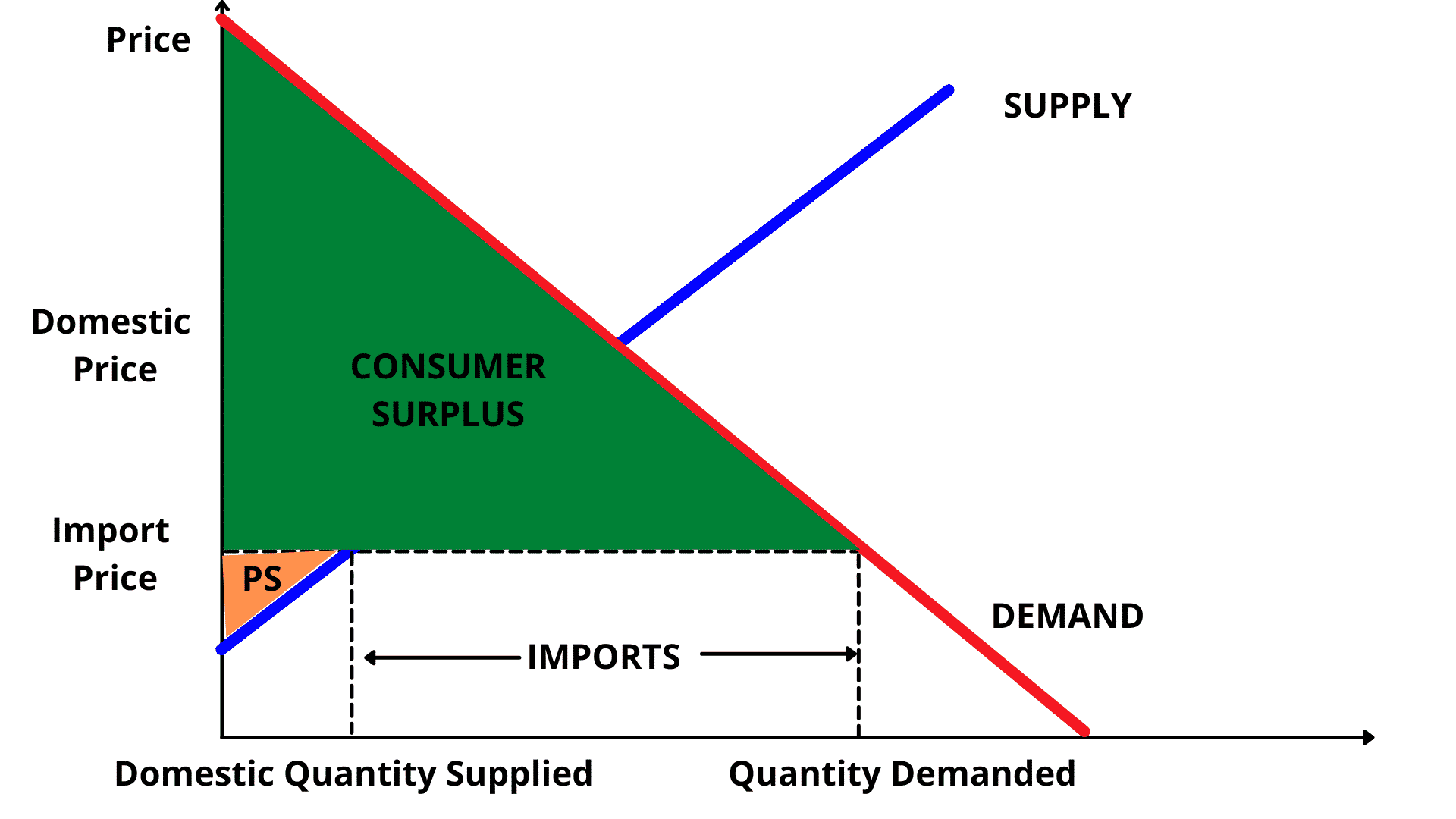

From the above graph, we have a situation where in order provide more supply to the consumer, the government allows free trade. The import price, also called the world price is lower than the domestic price, so consumers can acquire more goods and services at a lower price.

Before, the local economy was consuming what was being produced at the local domestic price, but now, the same product or service is being sold at the import price so that the consumers can acquire more goods and services at a lower price than the one being provided by local producers. This effectively increases Consumer Surplus and reduces Producer Surplus.

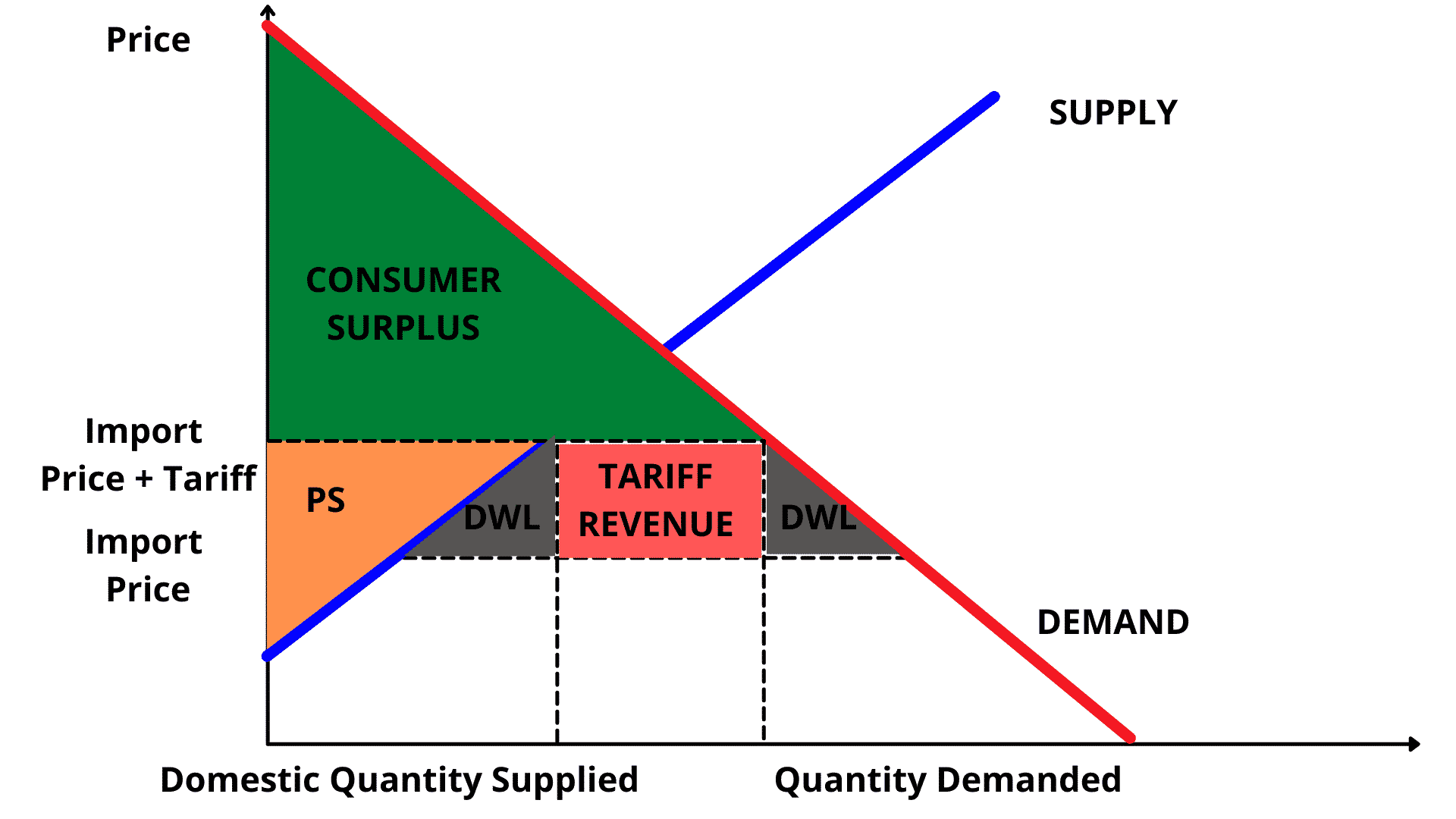

If on the other hand, the government wants a mix of both, meaning the quantity supplied of the goods and services coming from both local and foreign producers, they will establish what is called a tariff – a per unit tax on the imported goods and services. This increases Producer Surplus, reduces Consumer Suplus, introduces the government as a third player, as they will have their tariff revenue, causing a deadweight loss.

To restrict the quantity of products and services, the government can also implement what is called a quota.

Quota is a restriction imposed on the quantity of goods imported to the Country.

In this scenario, instead of a Tariff Revenue, the same box is called Quota Rent:

1. if the license is free, the quota rent goes to suppliers

2. if the license is paid, the quota rent goes to the local government as tax revenue.

A quota can be implemented by issuing licenses to foreign suppliers.

Rather than letting the country acquiring the goods to impose quotas, the exporting country can voluntarily do that and restrict the amount of goods being exported. This is called Voluntary Export Restraints or VER‘s

In this case, the licenses are imposed by the exporting government, self-imposing export limits to capture the quota rent.

Another form of government intervention is called Export Subsidies.

Export Subsidy is an incentive from the government where they pay producers a certain amount for every unit exported. This has the effect of increasing the quantity supplied, producer surplus increases, consumer surplus decreases as the export subsidy raises the price of the subsidized good in the exporting country. The government also loses from the subsidy payment as it is using tax revenue to fund it.