In this article, we will go through the main differences between perfect and imperfect competition, so you can get a clearer understanding of these concepts. All firms operating within each of these sections are called market structures.

What is A Perfect Competition?

Perfect competition is a microeconomics theoretical concept where all firms:

1. Sell the same product: a commodity like an apple.

2. Cannot influence the market price to sell it higher. They are called price takers.

3. Having market share has no influence on prices.

4. Buyers have complete information about the product being sold and the prices charged by each firm.

5. Can enter or exit the market without cost.

Perfect competition doesn’t happen in real life, as there is always some level of force exerted by one party or another that influences the market outcome. So, perfect competition contrasts with the more realistic model called imperfect competition.

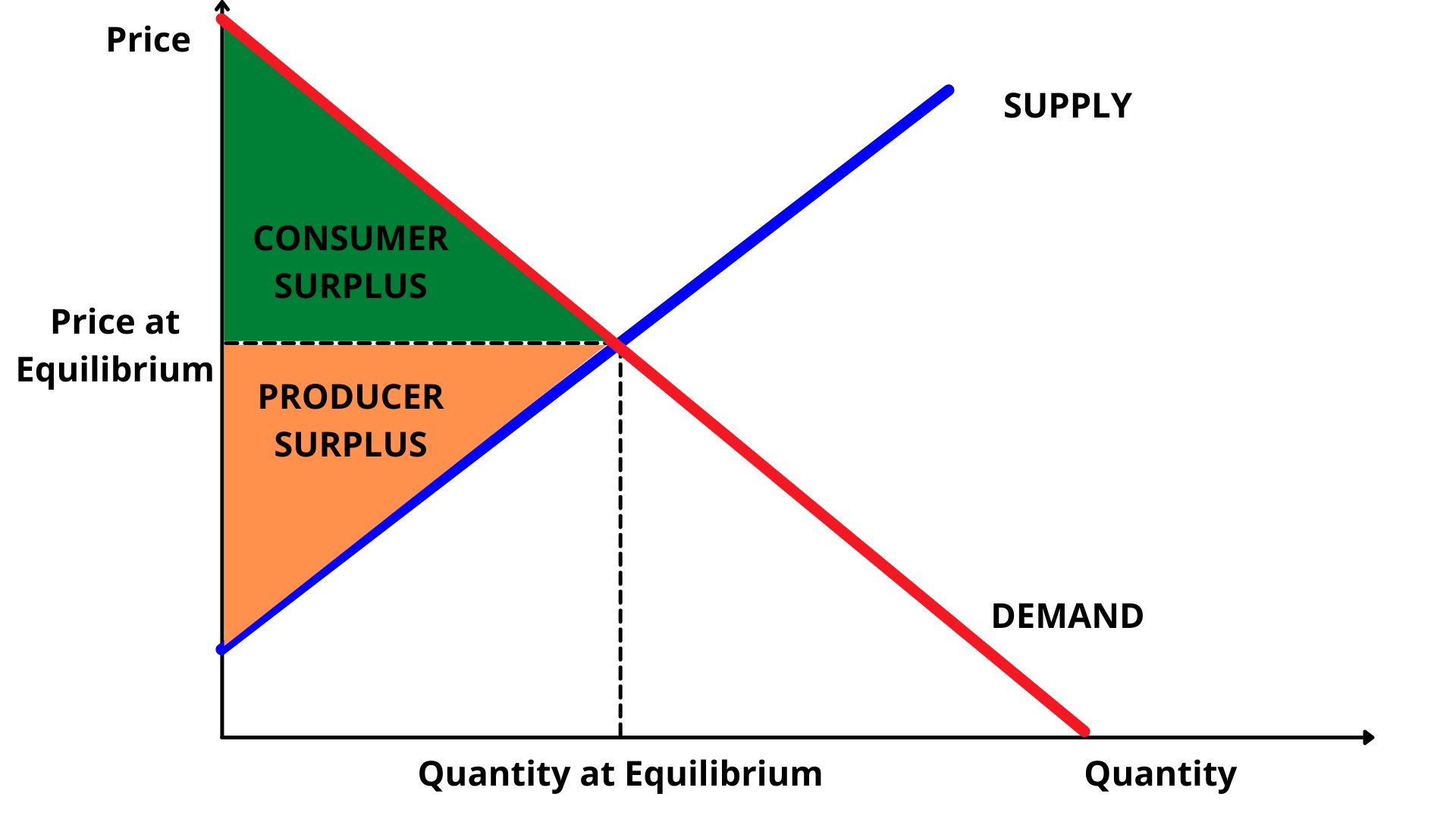

INDUSTRY (MARKET)

At the same equilibrium price and quantity, from the firm’s perspective, we have a horizontal demand curve. The firm’s maximum revenue is where marginal revenue ( an additional unit of revenue) equals demand.

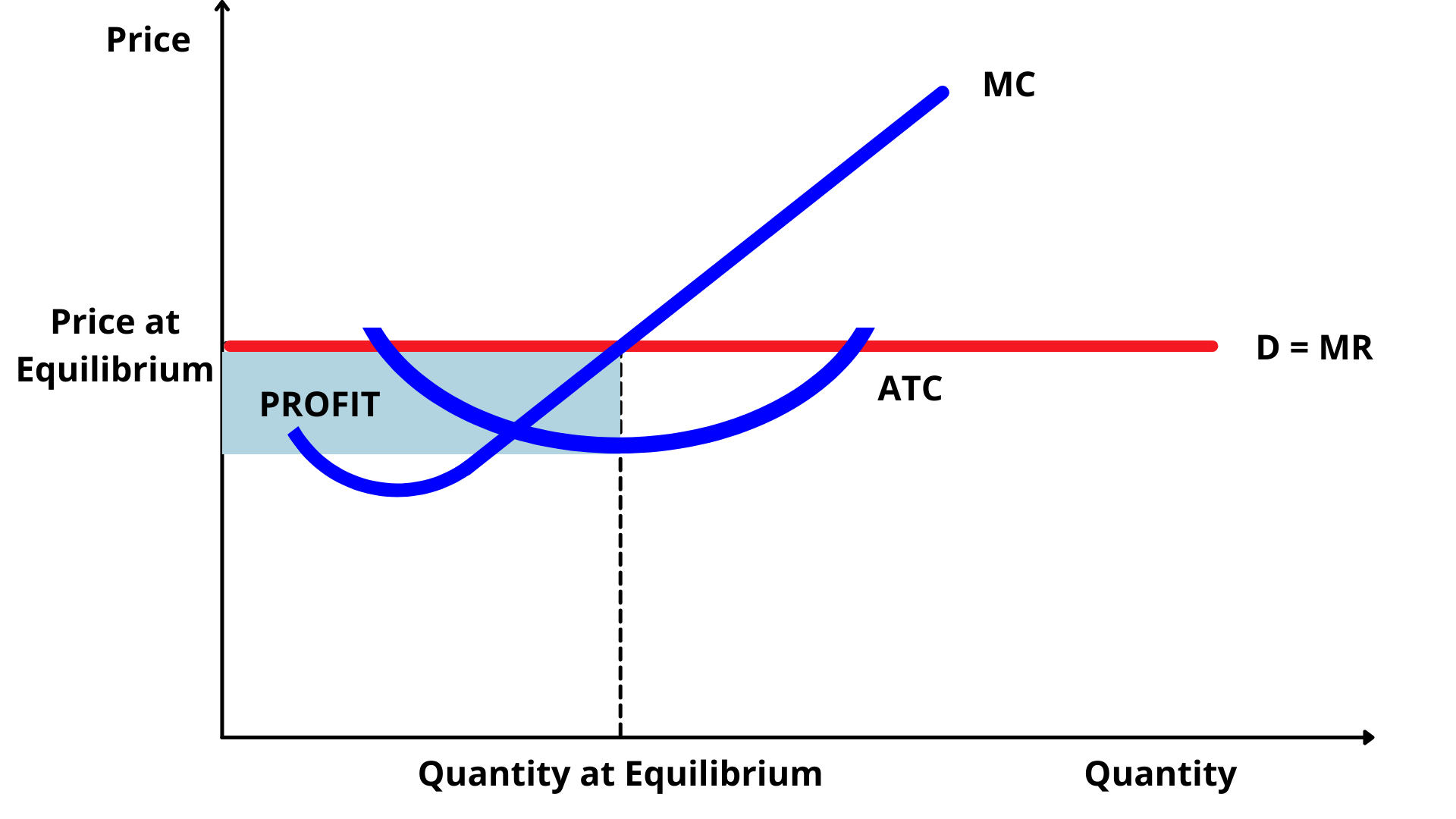

FIRM IN THE SHORT RUN

At the same Price in Equilibrium, in the short-run new companies that enter the market make a profit as their Average Total Cost is lower than the Price at Equilibrium for the same quantity.

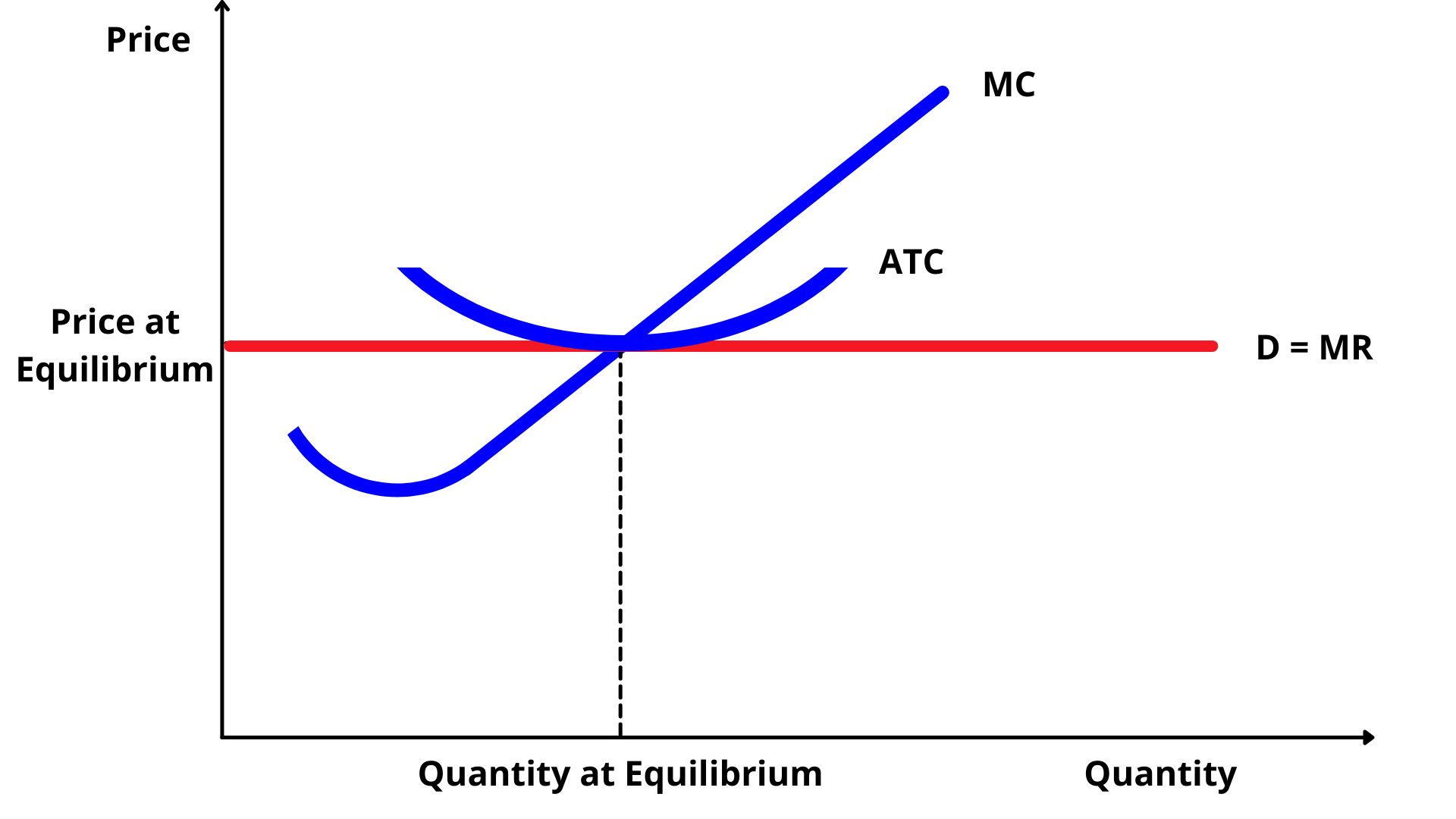

FIRM IN THE LONG RUN

But in the long run, more firms will enter the market, removing the ability of incumbents (older firms) to generate profit. Remember that this is a theory. It is a model in economics.

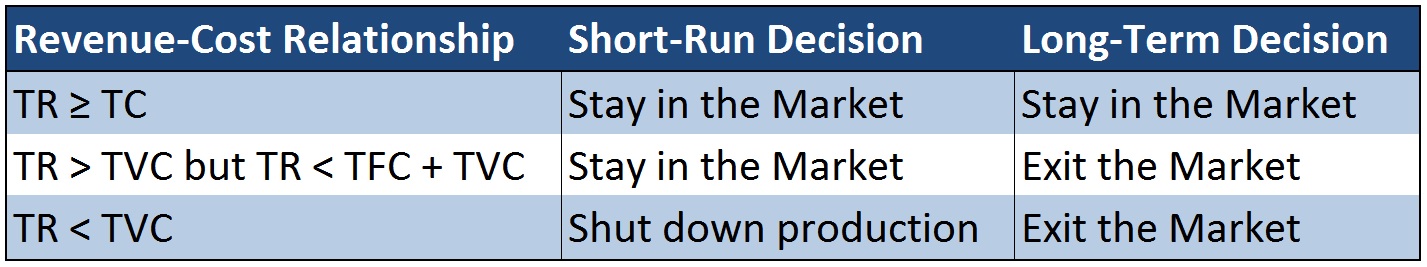

Behavior of firms and markets in the short run and the long run

In order to stay at float, firms make decisions based on the Revenue-Cost Relationship:

From the graph above we can see that in the short run, a firm operating in a perfectly competitive market will most likely avoid shutdown if it is able to earn sufficient revenue to cover its variable costs.

What is Imperfect Competition?

Imperfect competition is the situation where at least one of the set terms that define a perfect competition is unmet.

While perfect competition is more like a lab-theoretical example, imperfect competition is what happens in real life. Usually in three scenarios:

1. Monopolistic Competition

2. Oligopoly

3. Monopoly

What Is Monopolistic Competition?

Monopolistic competitors in comparison to perfect competitors have some brand power, some pricing power, and some level of difficulty to enter the market.

Good examples are brick and mortar stores like a coffee shop, gas stations or with a higher difficulty point to enter when some level of license or upfront capital is required like a gas station or contracts to enter a shopping mall.

One can’t say that Starbucks isn’t selling a commodity: it’s coffee, but they have brand power. Can you open your own version of Starbucks? Yes. And it is much easier than opening a pharmaceutical company.

But can you make the same type of revenue and profits out of the bat? Unlikely.

These are monopolistic competitors: some level of differentiation between products, some brand power, some pricing power and although a bit harder it is still an easy entry for new competitors.

Inefficiencies of Monopolistic Competition

Monopolistic firms are allocative and productively inefficient in both the short run and long run, because of excess capacity – a situation where a firm is producing at a lower scale of output than it can produce. Essentially excess capacity refers to a situation in which the demand for a company’s goods and services is less than its productive capacity.

Firms do this in order to cut back on costs when the quantity demanded declines. They want to sell as many units as they can, even if it means selling at a discount. This has the consequence of reducing margins, undermining weaker competitors, and having them go out of business.

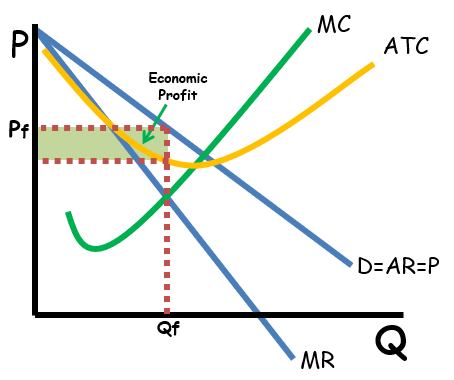

Characteristics of a Monopolistic Competition Graph

Marginal Revenue and Average Revenue are downward sloping curves

MR = MC

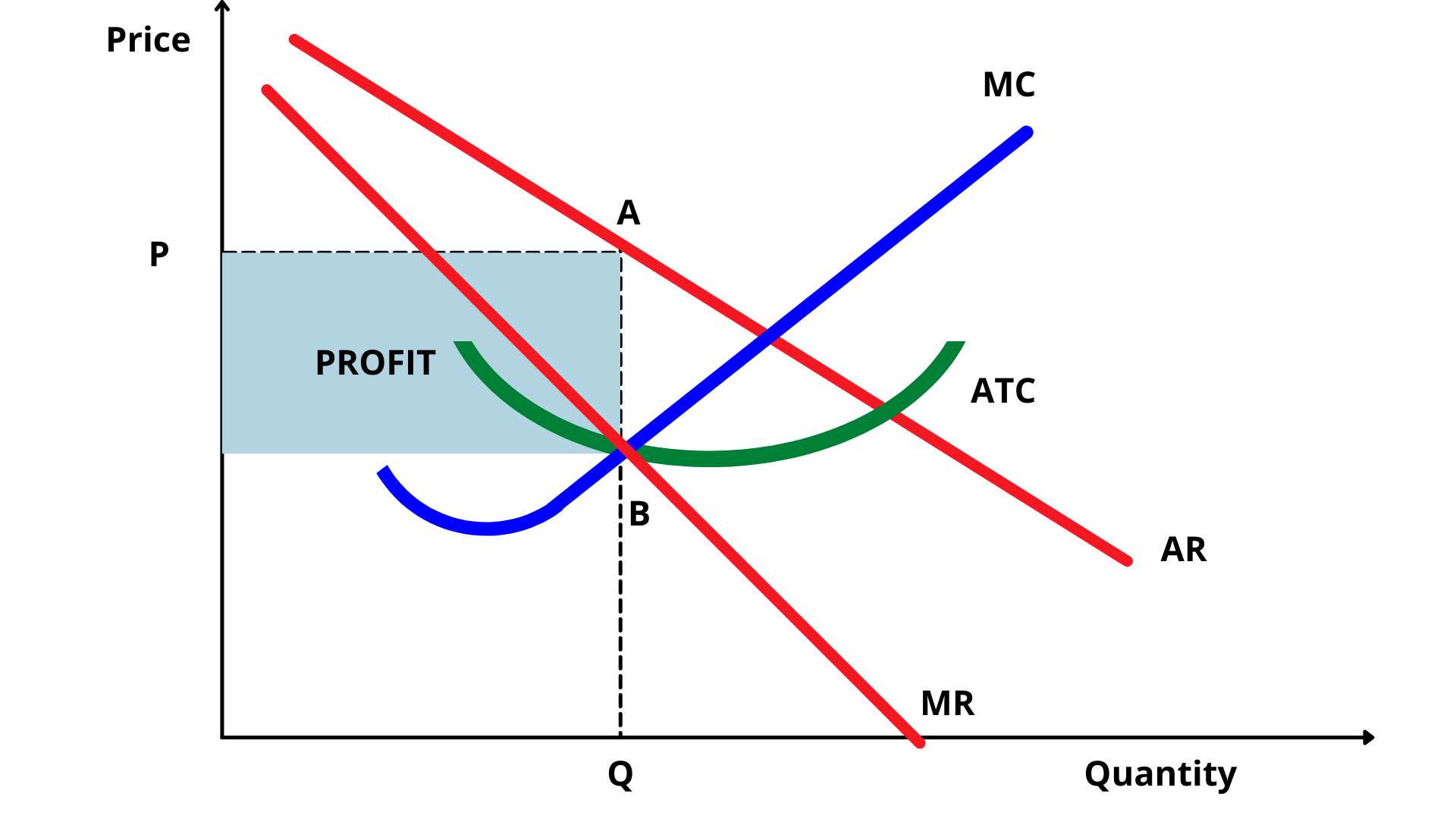

FIRM IN THE SHORT RUN

In the short run, the average total cost is below the average revenue, so the firm makes a profit.

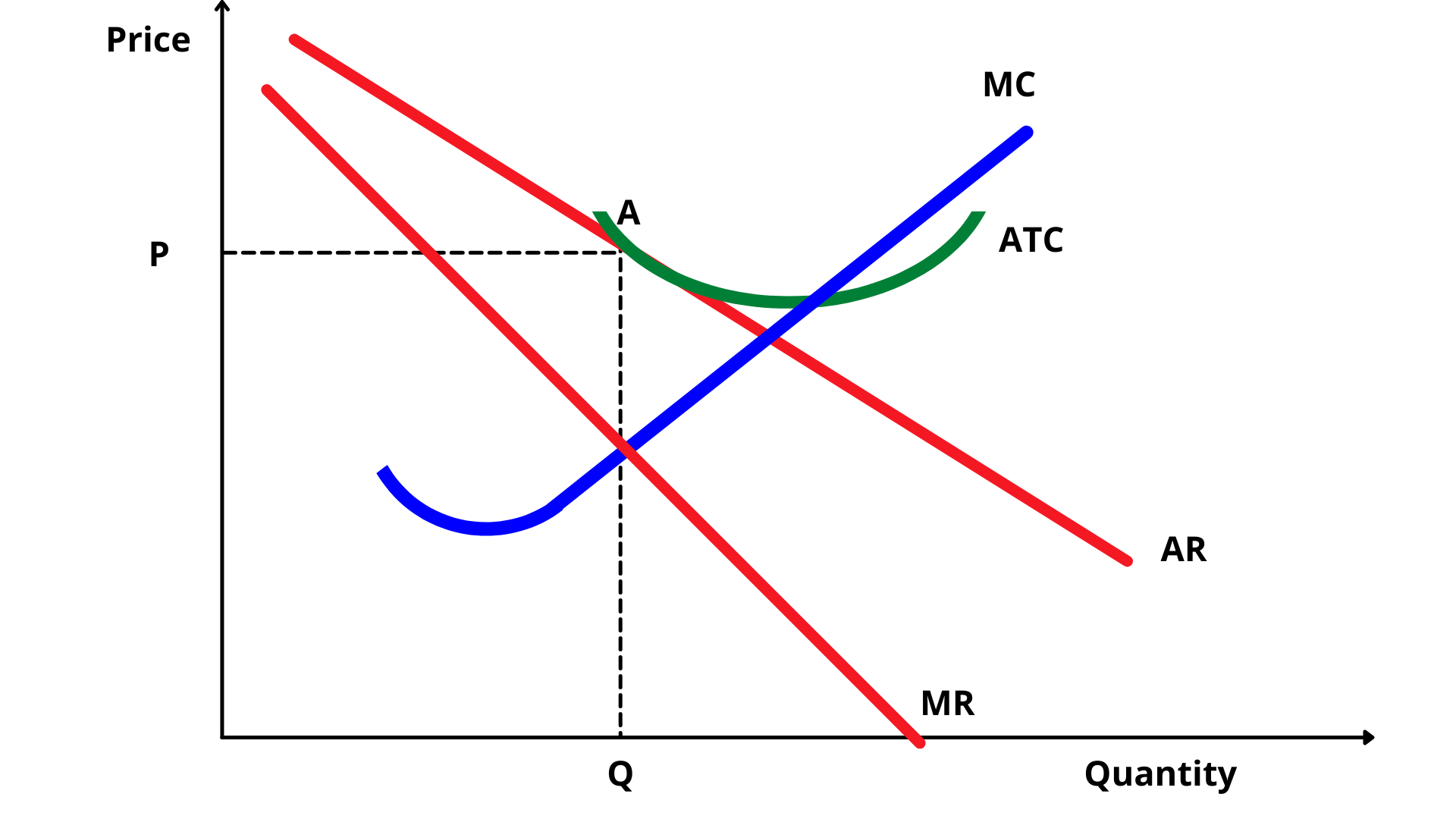

FIRM IN THE LONG RUN

In the long run, the average total cost is equal to the average revenue, so the firm makes no profit.

What Is An Oligopoly?

An oligopoly is a market form wherein a market or industry is dominated by a small group of large sellers. Electrical Companies, Pharmaceutical Companies are some examples. The product can be the same like oil or electricity or with some level of difference like automobiles, but if you notice that are not that many car companies as it is usually a conglomerate that owns several car brands.

In an oligopoly contrary to the previous examples, there are high barriers to entry: patents, capital requirements and more.

In order to gain the most from the customer, firms under a oligopoly scenario, adopt strategies in order to accomplish so.

Interdependence

Firms operating under an oligopoly are interdependent, which means they make decisions based on what each other is making: output, price, advertising,so they can make the most from each customer.

Collusion

Oligopoly firms make joint decisions without an explicit agreement, and act as if they were a single firm. Firms cooperate to restrict output and achieve the monopoly price.

Cartels

When competing firms in an industry collude to create with explicit formal agreements to fix prices and production quantities this is called a cartel.

KINKED DEMAND

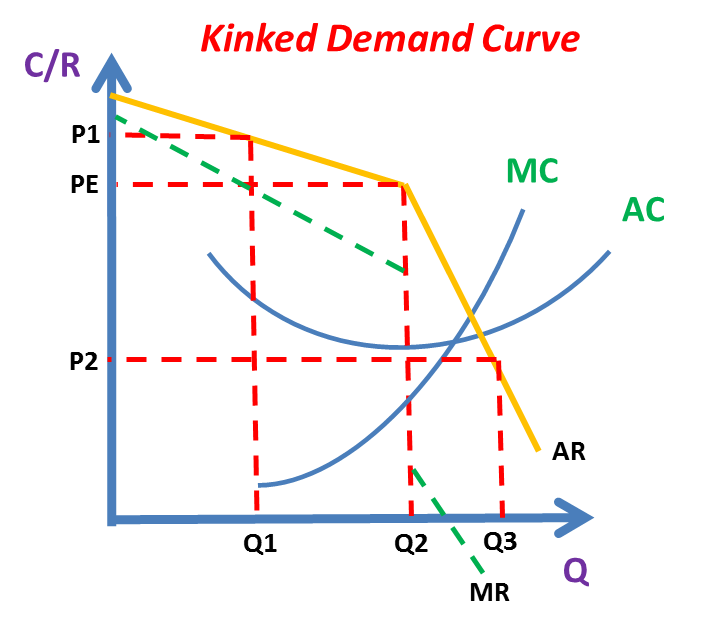

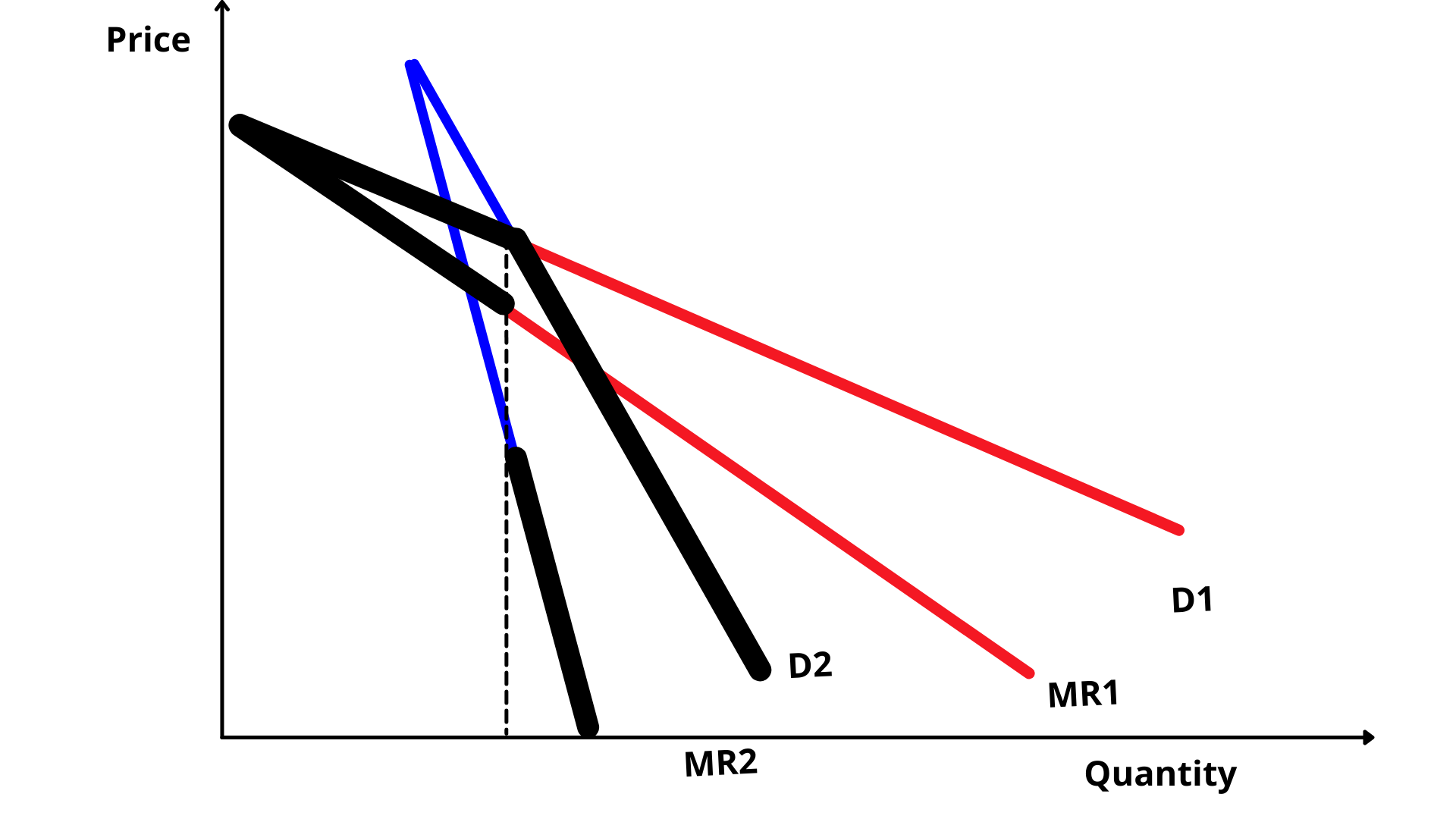

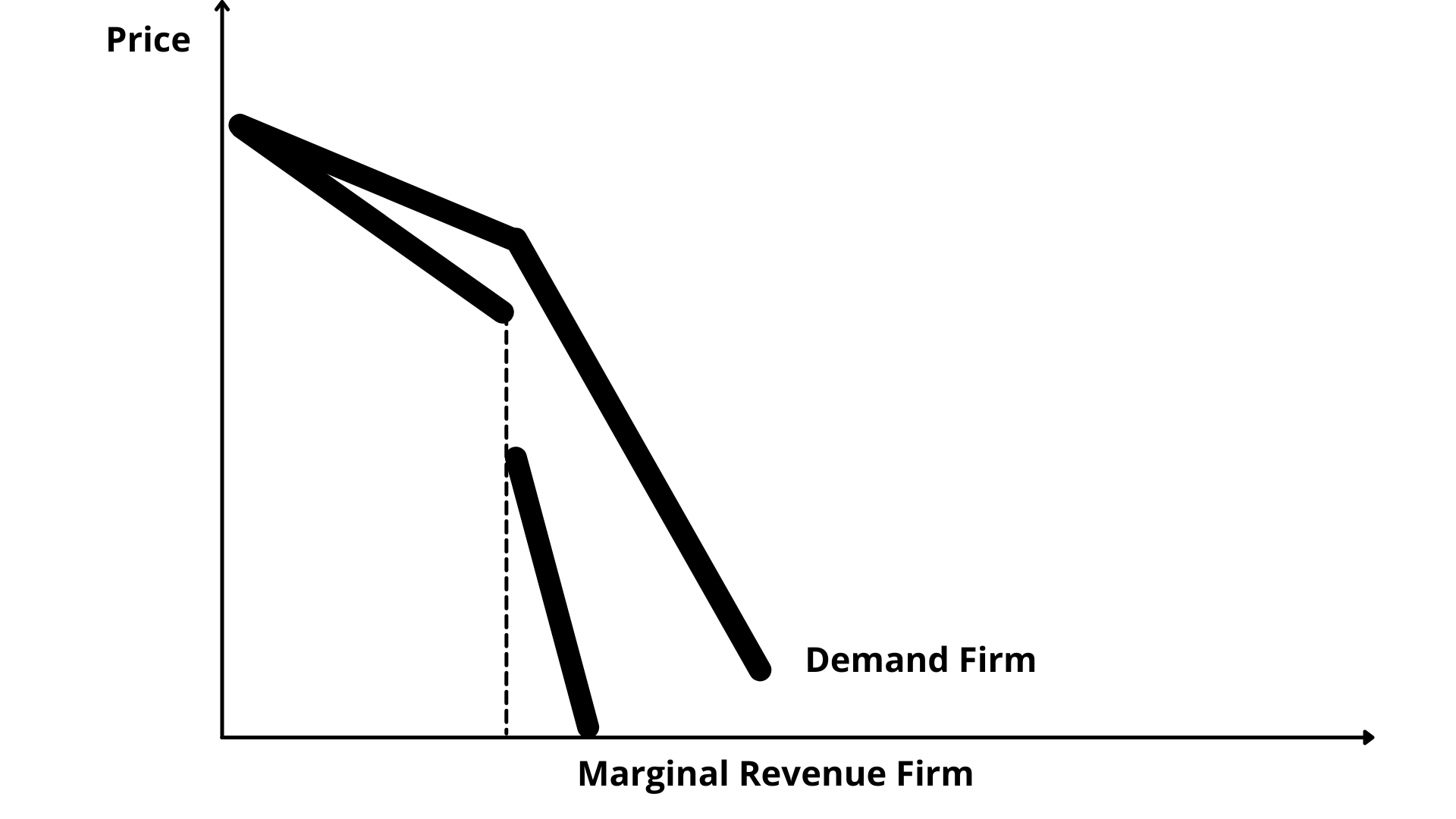

Oligopoly graphs seem to be more complicated, but are not. Let’s go through this together:

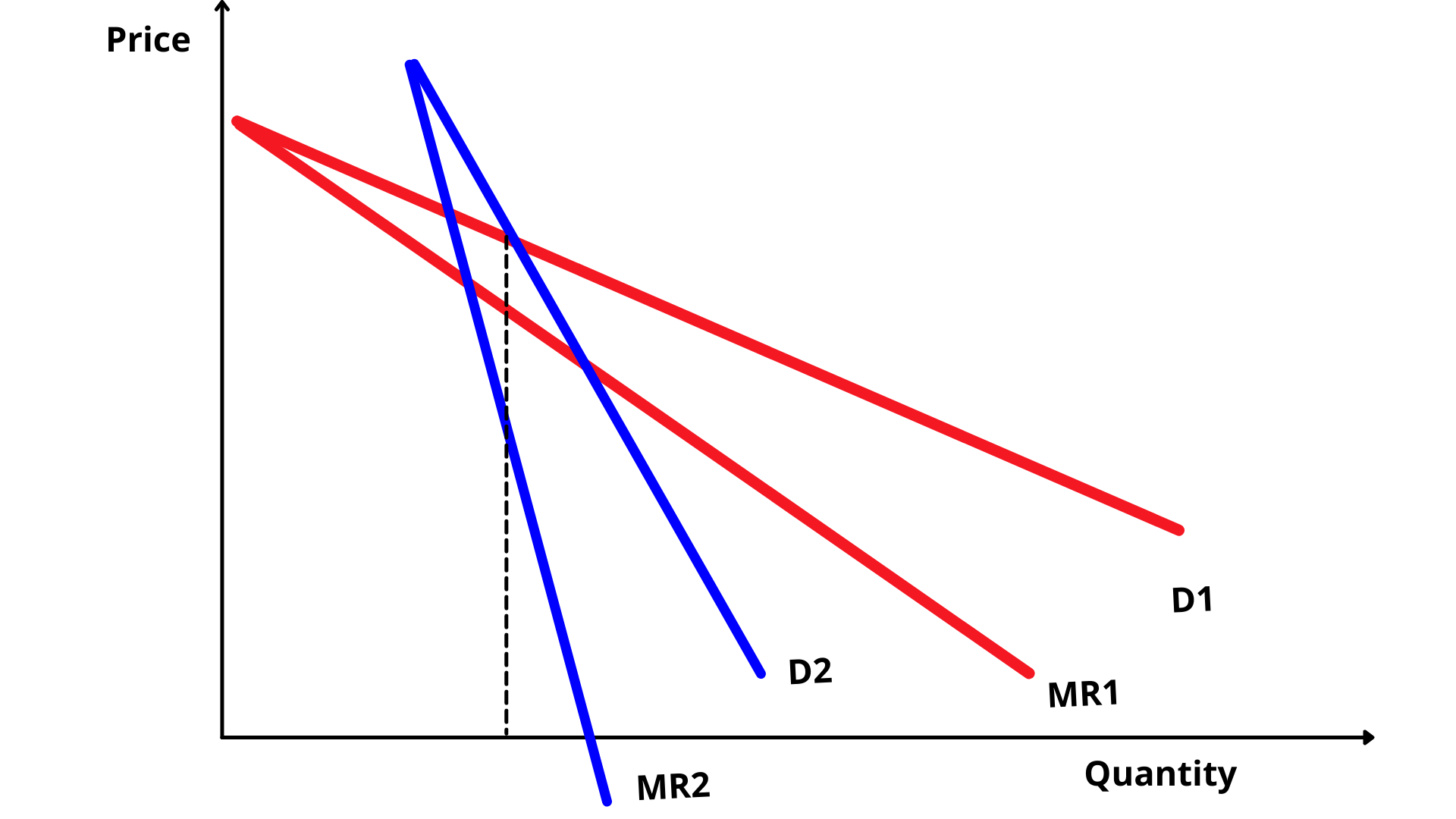

1. Notice the AR(Average Revenue) from 0 to Q2 has a different slope than from Q2 onwards. This is because these are two demand curves joined together, not one.

In oligopolies firms are interdependent, meaning they make decisions based on what the other ones are doing. If one firm increases prices, in most cases the other firms won’t follow suit, so this means that this firm will lose customers to the other firms. Here, the demand curve is more elastic when firms raise the price.

On the other hand, if the firm lowers the price, everyone will follow and not much is gained from that firm in terms of sales, you will have an more relatively inelastic demand.

So in order to represent this in one graph essentially we have two marginal revenues and demand curves represented and then joined. Check carefully the pictures below and its transition to the final presentation we wee here where there is a gap at Q2

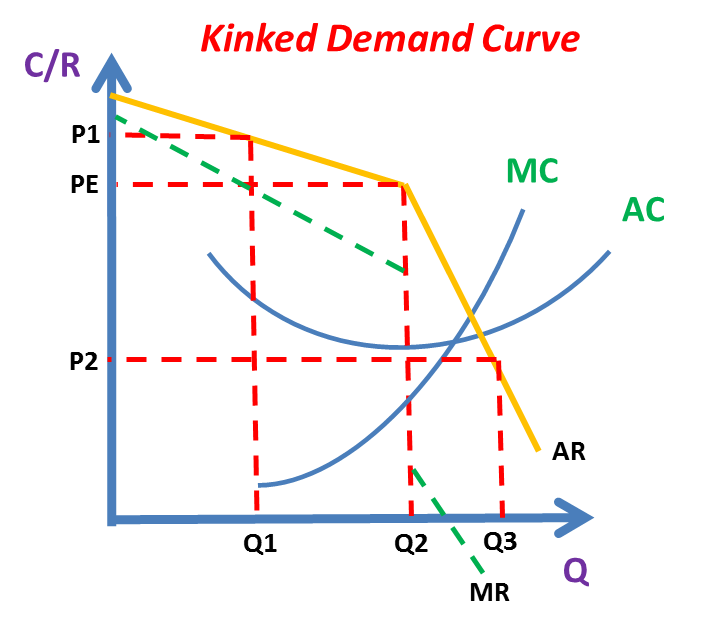

What is the Profit Maximizing Output?

The Profit Maximizing output is where Marginal Revenue (MR) = Marginal Cost (MC)

The Marginal Cost is the same no matter the market structure: it’s that Nike Logo upwards shaped curve.

Here the MC curve intersects MR at Q2. Since the MC curve stays here within this gap, the Price for the AR = Demand, will always be PE.

Essentially, firms don’t need to change prices, they need to optimize costs:

if the ATC (AC in this graph), is above PE, firms lose money.

if the ATC (AC in this graph), is at PE(the kink), firms breakeven.

if the ATC (AC in this graph), is below PE, firms make a profit.

What Oligopoly Firms do:

Price Competition – Although it doesn’t make sense, under an oligopoly firms still enter a price competition, known as a price war. Supermarkets and airlines are a good example.

Non – Price Competition – Firms enter what is called a non-price competition – starting by understanding that the Kink represents a Sticky price, firms engage in outdoing each other by focusing on branding, customer loyalty and quality to gain market share.

Collude – Also, firms in order to break the interdependence, tend to collude. Like we have seen, collusion is a form of market manipulation where without an explicit agreement, firms cooperate to restrict outpu and achiece monopoly prices.

All this leads us to the important concept under this market structure, called Game Theory.

GAME THEORY

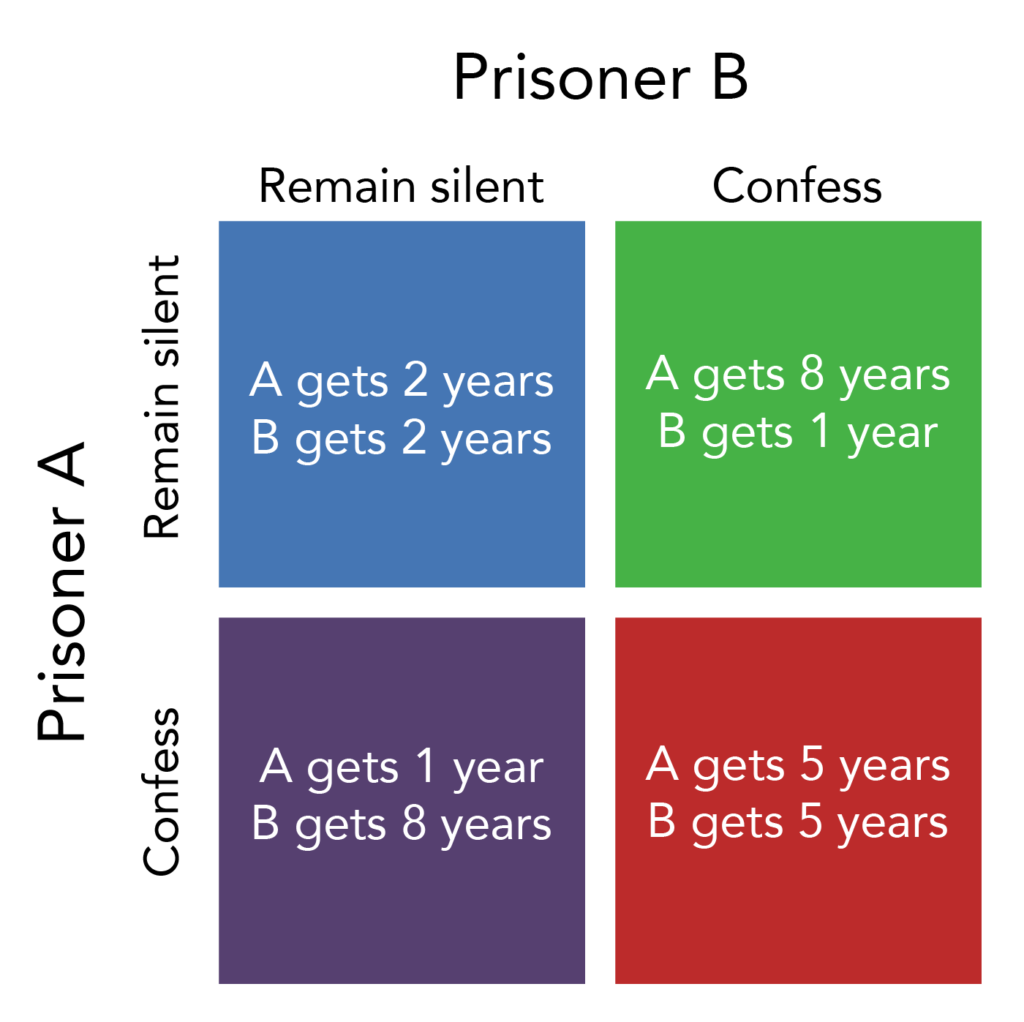

Game Theory is a study of the behavior of one player based on the decision of the other. In order to understand this concept better, lets look at an example.

Here we have a situation where two perpetrators were caught and kept in different rooms for questioning, now knowing what the other one is going to decide, so they are making a decision based on what the other one does

Game theory is usually represented as a two-fold option from each side. Here if Prisoner A remains silent, both get 2 years. If he confesses, he gets 1 year and Prisoner B gets 8 years.

Seen from Prisoner B’s perspective: If he remains silent both get 2 years. If he confesses, he gets 1 year and Prisoner A gets 8 years.

If both confess, both get 5 years.

Here an interesting situation happens: By focusing on each one’s personal interests both will end up worse. This is called the Nash Equilibrium or Prisoner’s Dilemna.

Let’s say Prisoner A thinks: If I confess I get 1 year and he gets 8. So let me confess.

Now, if Prisoner B thinks the same and confesses, both will get 5 years.

This is a dominant strategy as the underlying reasoning for each one is that, if both confess they will get a lower sentence, but as is turns out, they won’t.

So coming back to our Oligopoly markets, this confirms that firms should engage in Price rigidity: they should leave the price at that kinked point and focus on non-price competition(like branding and quality improvements).

So if firms collude, they will keep the prices sticky and both make a larger supernormal profit.

What happens is that, even when firms enter a collusive agreement, they still have an incentive to cheat, because they are thinking about the short term, and undermining their competitors right now seems to work in order to make a quick profit, but in the long run it won’t.

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

What Is A Monopoly?

A monopoly is a dominant position of an industry or a sector by one company, to the point of excluding all other viable competitors. Amazon, Google are some examples where it is unlikely that consumers use other alternatives in that industry segment than the main provider.

Sources or market power

Sources of monopoly power include: economies of scale, capital requirements, technological superiority, no substitute goods, control of natural resources, legal barriers, and deliberate actions.

There is no way around using other provider than the one on the market, so customers as individuals lose power over the prevailing supplier. They could only regain power if there was another provider and all changed to that one.

Profit Maximization

Monopolies are always going to supply the quantity where MR=MC, but because they control the market, they are going to sell it at the price where demand crosses that point.

They have an economic profit because the price is above the ATC.

This causes a deadweight loss seen from the triangle formed by the intersection of MC=D to the Qf point.

Inefficiency of a monopoly

So, in order o improve profits, Monopolies will always deliver less than they can as they are trying to increase profits by reducing costs.

Price Discrimination

Monopolies discriminate prices. These come in three different “flavours”:

In first degree price discrimination, the monopolist charges each consumer the highest price he is willing and able to pay.

In second‐degree price discrimination, the monopolist offers a variety of quantity‐based pricing options that induce customers to self‐select based on how highly they value the product (e.g., volume discounts, product bundling).

In third‐degree price discrimination, the monopolist can separates customers can by geographical regions or other traits. One set of customers is charged a higher price while the other is charged a lower price (e.g., airlines charge higher fares on one-day, round‐trip tickets, as they are more likely to be purchased by business people)

Natural Monopoly

There is a special type of monopoly called natural monopoly.

By looking at the previous graph we can see that ATC goes down and goe back up in a symmetrical way.

Here we see that the ATC curve is much wider than in a regular monopoly.

Economies of scale are achieved from 0 to the quantity where MC = ATC, but in a natural monopoly, the ATC curve is much wider, so a natural monopolist has the ability to provide more quantity under their economies of scale.

In order to achieve its minimum average total cost, it much produce a much higher quantity than the regular monopoly.

This is why you see this firm’s Marginal Cost Curve (MC), also with a higher range of output. Both will intersect where ATC is at its lowest price.

Examples of industries like this are Water provision Industries, Gas Companies and other Utility Companies.

This is one market structure where consumers actually benefit from one firm producing water for the whole country.

The infrastrucured needed has such high fixed costs associated with it, that engaging in price wars would leave consumers worse off. So essentially one firm can supply the whole market and the socially optimum quantity can be provided at the lowest price due to the economies of scale achieved by the natural monopolist.

What if they don’t?

If natural monopolists which to increase their profits, they would rather supply where MR = MC, creating a deadweight loss to consumers, so in order to avoid this, natural monopolists are subject to government regulation.

Governments use price controls and subsidies to achieve this.

Since the company wouldn’t voluntarily produce above where MR = MC, if the government imposes a price ceiling, capping the company to charge a higher price on the let’s say water bill, and forcing them to incur a loss, they can’t keep this going as the firm would have to shutdown in the long run due to the heavy losses as their costs are so high.

So the government pays the natural monopolist a subsidy in order to have them produce at a the required quantity.

SUMMARY

In this article we talked about the differences between perfect and imperfect competition and its main market structures.